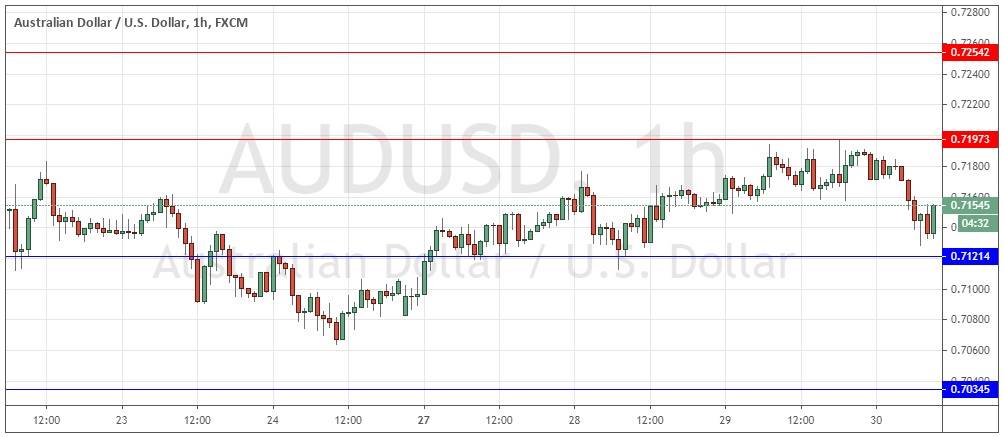

New 1-year high price made at 0.7197

Yesterday’s signals produced a short trade from the bearish reversal at the resistance level at 0.7197. I would exit this trade right away even for the small floating profit on offer at the time of writing as the price movement begins to look less predictable.

Today’s AUD/USD Signals

Risk 0.75%.

Trades must be entered from 8am New York time Thursday to 5pm Tokyo time Friday.

Long Trade Ideas

- Long entry following bullish price action on the H1 time frame immediately upon the next touch of 0.7121 or 0.7035.

- Place the stop loss 1 pip below the lowest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade Ideas

- Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.7197 or 0.7254.

- Place the stop loss 1 pip above the highest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote yesterday that directional movement was unpredictable due to the FOMC release, but that there were two resistance levels above, at 0.7197 and 0.7254, both of which could be strong due to their confluence with major round or half numbers.

This was a good call as the only key level which was reached – 0.7197 – acted as firm resistance and produced the high price of yesterday right to the exact pip.

Although this technically produced a new 1-year high yesterday, and support continues to hold – both of which should be bullish signs – the price action is unconvincing, and we seem to be entering a ranging period here.

It does seem as if the Forex market needs to consolidate for a while after an unusually long directional movement against the U.S. Dollar, following yesterday’s FOMC release.

However, we have key U.S. GDP data coming up early in the New York session today which will be closely watched, and this could create more price movement than we have seen so far today.

I am prepared to take reversals at any kind of key level, whether support or resistance, as I expect ranging conditions here over the near term. There is more doubt over the Australian Dollar as it is starting to seem as if the coronavirus pandemic will begin to have a worsening impact upon the Australian economy. Regarding the USD, there will be a release of Advance GDP data at 1:30pm London time. There is nothing of high importance due concerning the AUD.

Regarding the USD, there will be a release of Advance GDP data at 1:30pm London time. There is nothing of high importance due concerning the AUD.