The Australian dollar initially pulled back a bit during the trading session on Tuesday but then found buyers to turn around and reach towards the 0.69 level. This is an area that has been resistive as of late, so it is not a huge surprise to see that we had pulled back from there. Looking at this market, we continue to chop back and forth, and I think that we are going to continue to see a lot of struggles in this area, as the Australian dollar is sensitive to risk appetite in general. If the markets are generally feeling like they want to take on risk, this pair tends to rise. Obviously, the exact opposite can be true as well, as the US dollar tends to be attractive due to bonds and the general safety of the greenback in times of fear.

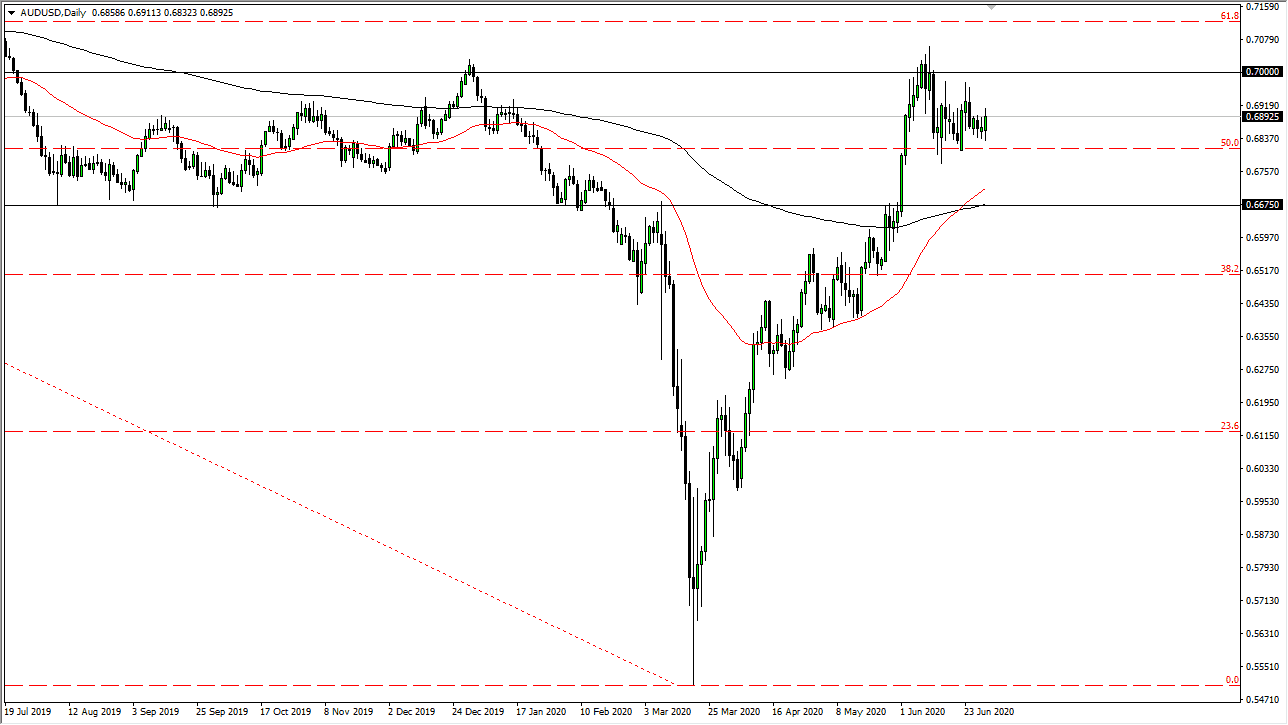

Looking at the chart, you can make an argument for a descending triangle, so that is another reason to think that we may pull back. To the downside, the market is likely to go towards the 0.6650 level. That is previous resistance, and previous support. The 200 day EMA is sitting right at that area, and the 50 day EMA has just crossed above there.

What is even more important as the 0.70 level above, as it begins a significant zone of resistance that the market has yet to be able to break. There seems to be a lot of resistance that extends all the way to the 0.71 level, so if we were to break above there it would be a huge move higher just waiting to happen as the market would be changing the overall trend. However, I am a bit leery of that idea as it would suggest that the Chinese economy was suddenly going to take off, as global demand would pick up drastically. I do not see that happening in an environment where we see so much in the way of unemployment in major economy such as the United States. With all of that, I do think that eventually we see money flow back into the treasury markets, which of course could send the US dollar higher overall. However, I remain flexible enough that if we were to turn around a break above the 0.71 level, then I am going to buy-and-hold the Australian dollar for several handles, as I believe that the 0.80 level could be targeted.