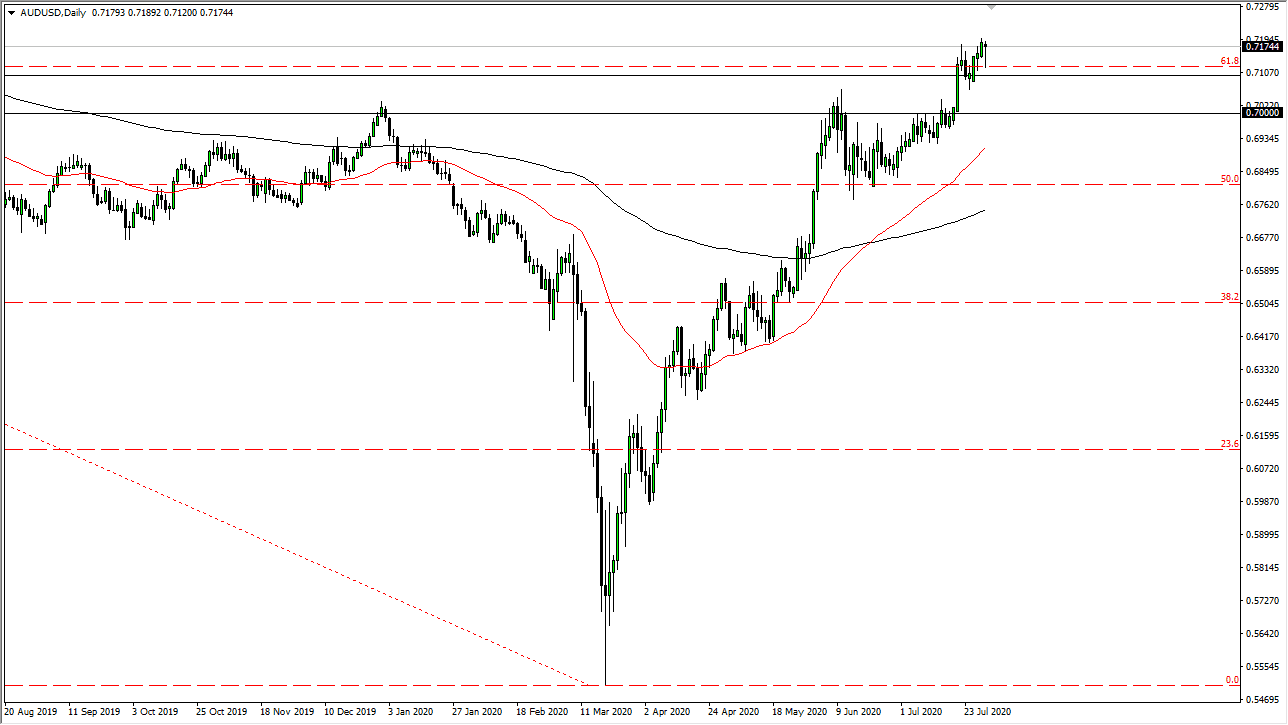

The Australian dollar initially fell during the trading session on Thursday but found support again as we have turned around and exploded to the upside. The Australian dollar has been in an uptrend for some time, and the fact that we simply continued that on Thursday should not be a huge surprise. The 0.71 level continues to offer a significant support, and I think that area extends down to the 0.70 level. In fact, I look at the 0.70 level as a “floor” in the market.

The market breaking above the top of the hammer would be a very bullish sign and opens up the possibility of a move towards the 0.73 handle. I think given enough time we will almost undoubtedly see a move to at least that, if not as high as the 0.0 level over the longer term. The Australian dollar has a lot of things working for it, but without a doubt the biggest thing working for right now is the fact that the Federal Reserve is working so feverishly against the US dollar. As long as it keeps its monetary policy extraordinarily loose, then it makes sense that the Australian dollar will be a beneficiary, just as many other currencies have been.

The Federal Reserve is without a doubt the biggest factor in currency markets most of the time, and this time will not be any different. Yes, the Australian dollar is levered to the Chinese economy, but at this point the focus is completely on the greenback. The US dollar is losing ground against almost everything so I would not anticipate anything different here. Australia does not matter in this equation. That is the same thing that can be said about the European Union and the United Kingdom. To the downside, even if we were to break down below the 0.70 level it is likely that we should see a move down towards the 0.68 handle. If we were to break down below there, then I might be able to buy the idea of a trend change to the downside again but the fact that we have broken higher it is likely that the longer-term trend is most certainly to the upside. Long-term trends in the Forex markets tend to last several years, so therefore it might be a while before we have to sell again.