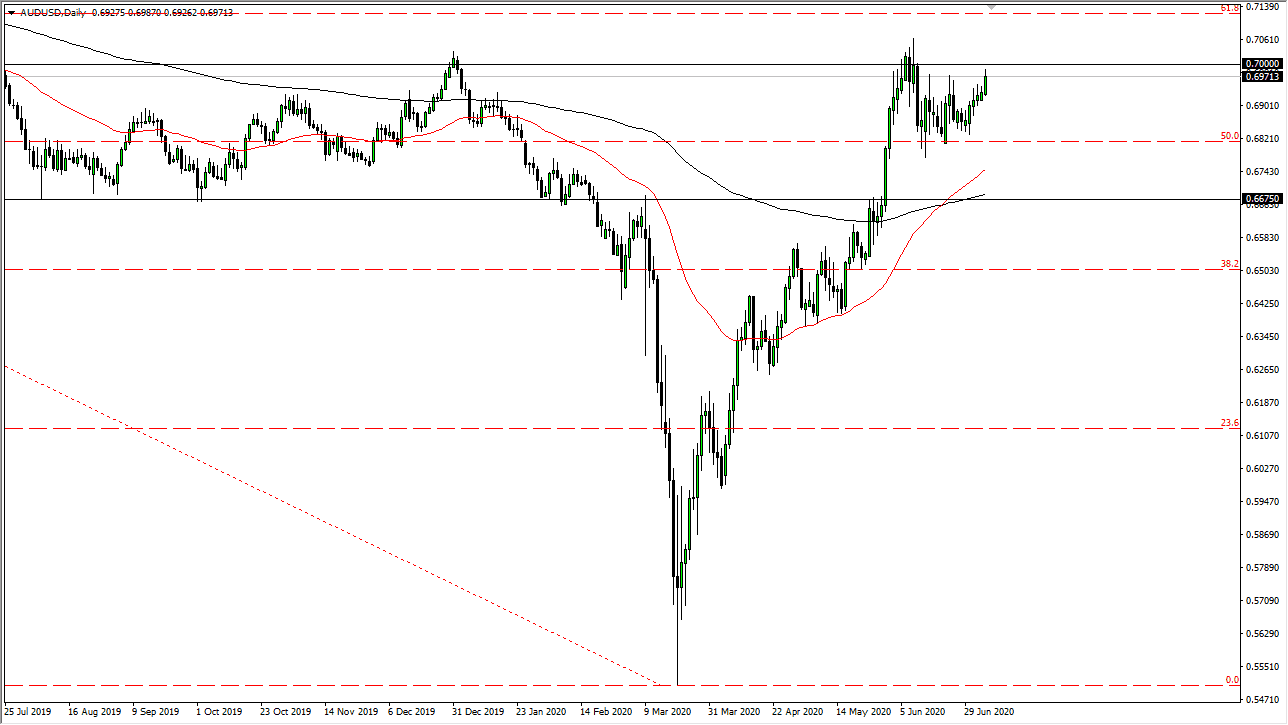

The US dollar rallied during the trading session on Monday, reaching towards the 0.70 level above. That is the beginning of massive resistance in the Australian dollar that extends all the way to the 0.71 handle, so I think it is only a matter of time before we see sellers come back in and push this pair lower. In fact, I am more than willing to short this market on signs of exhaustion going forward as we have struggled so far to break above that area. However, if we were to break above the 0.71 handle, that would change everything.

To the downside, the market is likely to continue finding support at the 0.68 handle, an area that has been rather supportive of the last couple of weeks. After that, we have the 50 day EMA reaching towards that level, and I think that could offer a little bit of support. However, if we were to turn around and breakdown below that level, then we will go looking towards the 200 day EMA which is relatively close to the 0.6675 handle. That is an area that was previously resistant, so it makes sense that it would be supported now.

Do not forget that the Australian dollar is overly sensitive to the Chinese economy in all things involved in Asia. This is mainly because the Australian dollar is in high demand when the Chinese are buying copper, iron, or aluminum from Australia. The Australians provide Asia with a huge bulk of its hard commodities, so this is why the Aussie is considered to be a “risk-on currency.” On the other side of this equation, we have the US dollar which is considered to be one of the safest currencies in the world. This is because traders will go looking towards the US Treasury markets for safety when there are times of concern out there. Right now, there are plenty of headlines that could throw the market in either direction, but one would have to think that it is only a matter of time before the negativity overwhelms the market. This is why I have no qualms about shorting this market near the 0.70 level, because if we were to break above the 0.71 handle, then the market is likely to turn into a “buy-and-hold market.” In other words, if I do lose a little bit of money trying to short this pair, I will make it back hand over fist on a breakout.