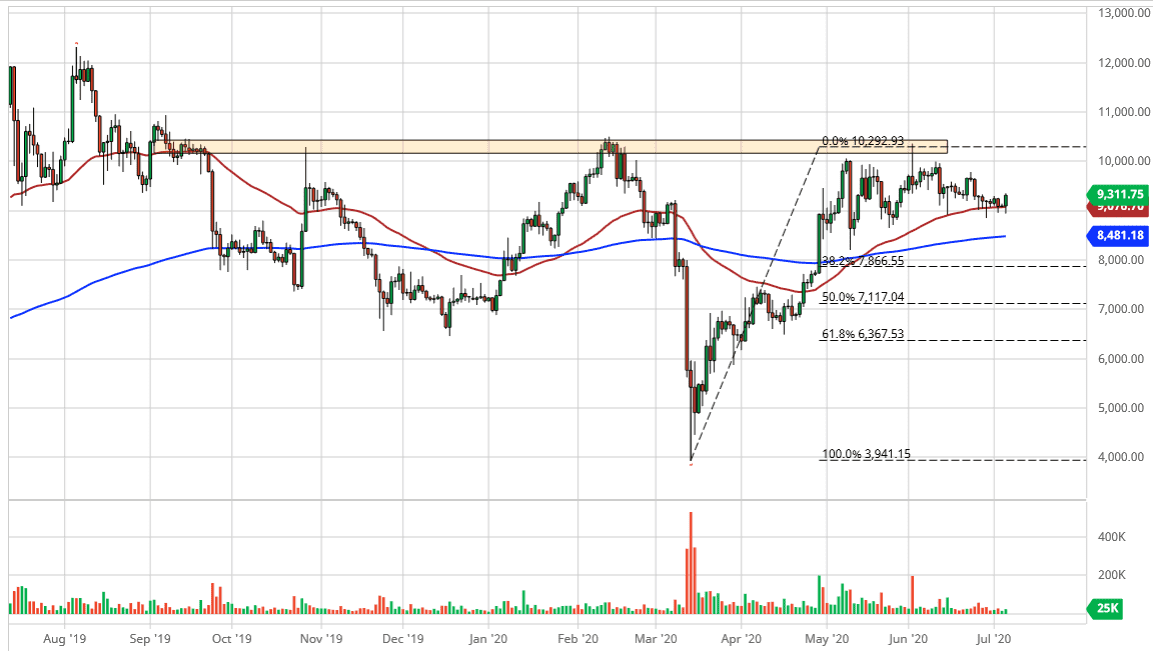

The bitcoin market was relatively quiet over the weekend, but the Monday session did see some buying near the crucial $9000 level. This is an area that is starting to present itself as significant support, and the fact that the 50 day EMA is sitting right there certainly does not hurt that argument either. The shape of the candlestick is relatively strong, so I do think that it is only a matter of time for we see buyers push Bitcoin even higher. Over the weekend, I have changed the shape of the consolidation pattern that I visualize on this chart.

Until the last several candlesticks on the daily chart, I had envisioned this as an ascending triangle. This ascending triangle is very bullish, and it makes sense considering that the market had been pressing the crucial $10,000 level. If we are going to break out, it would obviously take quite a bit of effort to finally break above what had been a psychologically significant resistance barrier and an area where we have broken down from. However, we have drifted through the uptrend line of the ascending triangle, but we had not broken down below it. At that point, it invalidates the ascending triangle, but that does not necessarily mean that suddenly you become very bearish. In fact, at this point, I believe that we are trying to form some type of rectangle, which still leads to the old adage: “consolidation leads to continuation.” In other words, the market has taken time to build up the necessary momentum to break out to the upside, assuming that is in fact what we do over the longer term.

In the short term, I would anticipate that there should be plenty of support between the 50 day EMA underneath and the 200 day EMA which is significant in and of its own right. Because of this, I think the dips continue to offer buying opportunities and throw in the fact that the $9000 level is the top of that range, then you have a perfect scenario for buyers to return. If we can break above the top of the candlestick for the trading session on Monday, then I think Bitcoin will go looking towards the $9750 level in the short term. Above there, we should start looking towards $10,000 again. I believe that the $10,000 level begins significant resistance all the way to at least the $10,500 level beyond that.