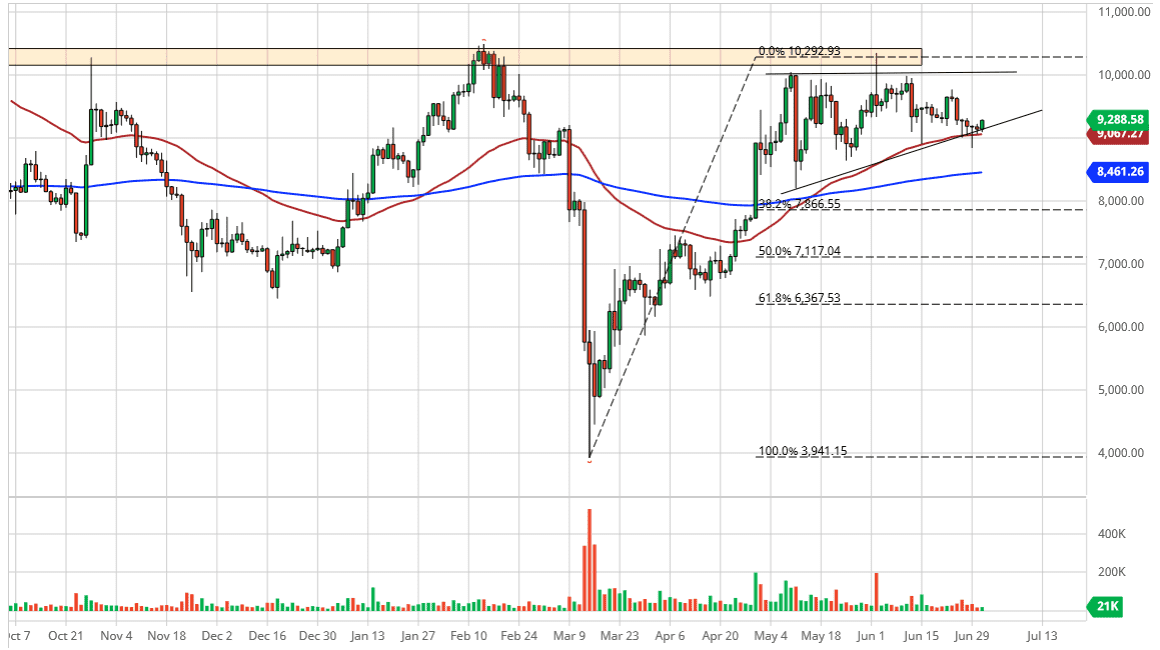

Bitcoin traders bond during the trading session on Wednesday as we continue to grind across the 50 day EMA and the uptrend line that makes of the larger ascending triangle. For this reason, the market looks highly likely to find buyers down at this area. Also, the fact that it is hovering around the $9000 level, an area that is a large, round, psychologically significant figure. Therefore, it is more than likely going to bounce a bit from here as we are in an uptrend and it is likely that the devaluation of fiat currency will continue to help the value of Bitcoin rally.

Looking at the chart, the market has plenty of technical reasons to bounce, but quite frankly with so much in the way of central banks stimulus out there, it makes sense that traders will try to find other assets. Bitcoin continues to work as a way to hide money away from that type of wealth destruction, so at this point it makes sense that we are going to continue to go towards the $10,000 level eventually. That is the major round figure just waiting to be tested and extends all the way to the $10,500 level. At this point, the market is likely to show signs of selling pressure in that general vicinity, and I think that if we break above the $10,500 level, it is likely that we could go to the $12,000 level.

To the downside, if we break down below the 50 day EMA, and perhaps the hammer from the Monday session, then it is likely that we go down towards the 200 day EMA after that. I do not have any interest in shorting this market, and I think that if we pull back it is likely that people will simply look at that as a potential value play. While I do think that it is going to be very noisy and difficult, I believe that ultimately Bitcoin continues to go higher, and it is likely that traders will continue to look at this as a “one-way bad” over the longer term. As far as selling is concerned, we need to break down below at least the $8000 level before we could even have that conversation. Ultimately, buying on the dips has continued to work for some time and I think that is not going to change anytime soon.