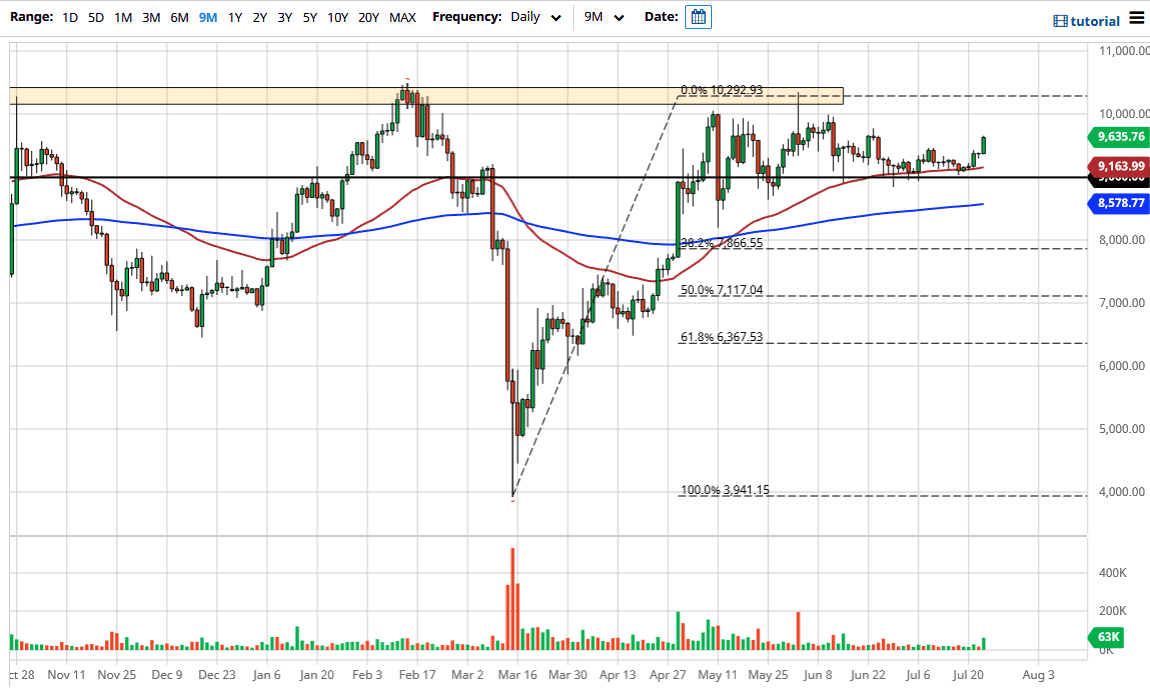

Bitcoin markets have rallied a bit during the trading session on Thursday, breaking above the 9500 level. Ultimately, this is a market that has been building a bit of a base for some time, and now looks like it is ready to go higher. The $9000 level has been crucial, as we have seen it offer plenty of support for over a month now. The 50 day EMA is sitting just below, near the $9163 level. This is a market that I think is going to try to reach towards the crucial $10,000 level above, an area that has been tested a couple of times several weeks back. It is of course a large, round, psychologically significant figure so it does make sense that there would be a bit of selling pressure in that area, but it is very attractive and will have people aiming for it.

Looking at this candlestick, you can see that we are closing towards the top of the candlestick and range of the day, which is always a good look because it means that traders were willing to hang out and stay long of the market. When you look at the longer-term chart, you can see that the $9000 level underneath is significant support, just as the $10,000 level above is resistance. The $10,000 resistance area extends all the way to the $10,500 level, so I think it is going to take quite a bit of momentum to finally break out above that area. If and when we can close above the $10,500 level, it is likely that we will continue to go much higher and it could kick off the next leg to the upside.

Keep in mind that Bitcoin is just now starting to get a boost when the US dollar has been sold off rather hard over the last several weeks, so the question is whether or not it is going to be a sustainable move? All things being equal, to the downside there is the 50 day EMA and the 200 day EMA, offering a “zone of support” right around that crucial $9000 level. I do believe that it is only a matter of time before we rally from here, but in the meantime, you have to assume that we are simply trading in a larger rectangle with more of an upside bias like this chart has shown us for some time.