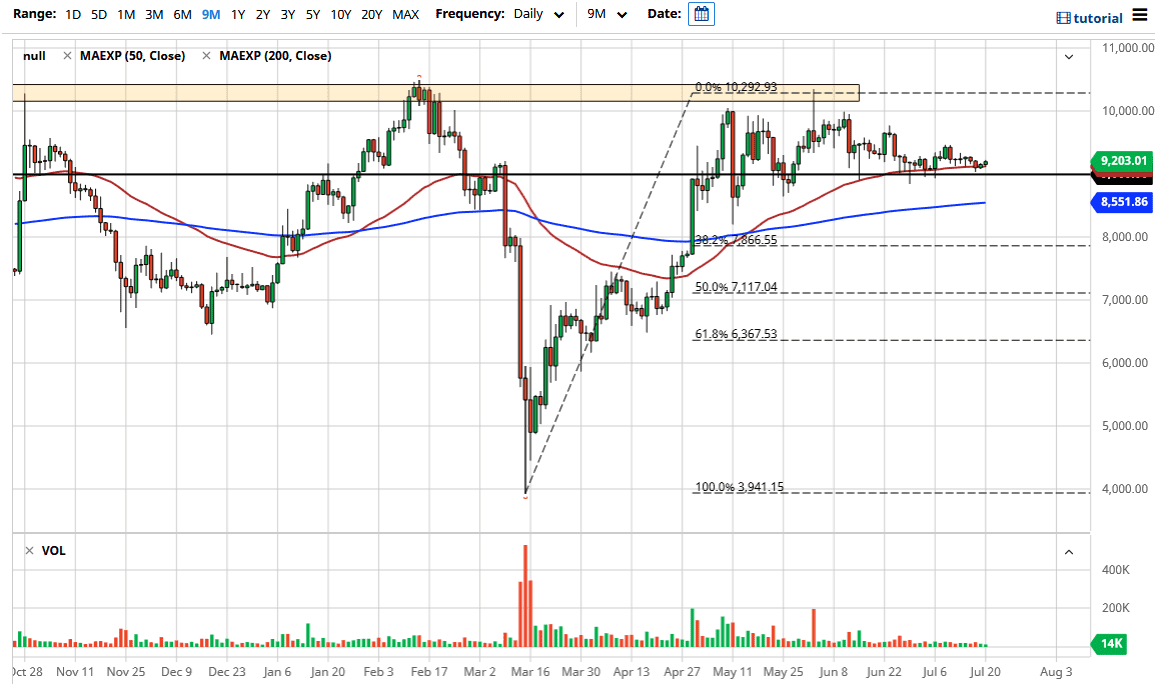

Bitcoin markets initially dropped a bit during the trading session on Monday to drift below the 50 day EMA. There were buyers underneath there to turn the market around and send it a bit higher, as the $9000 has been a major support level, and at this point in time, it looks as if the $9000 level will continue to be an area that is important. The 50 day EMA is flattening out so it does look supportive as well, and it is an indicator that a lot of traders pay attention to, especially when it comes to the Bitcoin markets.

Underneath the $9000 level, the next major support level would be the 200 day EMA which is closer to the $8550 level. That is an area that I think will continue to attract a lot of attention so as long as we stay above there. The market has been grinding back and forth overall for the last several months, but as you can see the market is likely to continue to see a “buy on the dips” mentality. There does seem to be of bit of a “zone of support” extending between the 50 day EMA and the 200 day EMA, so at this point, I think you need to be looking for value. To the upside, the $10,000 level would be a target, which perhaps continues to see a lot of resistance that extends all the way to the $10,500 level.

If we were to break above the $10,500 level, then the market is likely to go much higher. That would insinuate a major breakout. That being said, Bitcoin does not seem like it wants to go anywhere, and the fact that the US dollar has been hit so hard against other fiat currencies and Bitcoin has done almost nothing is a bit concerning. That being said though, Bitcoin is apt to go sideways and nowhere for long periods of time, so do not be surprised if we have nowhere to be for a while. That being said, I do not have any interest in shorting until we get below the 200 day EMA, something that does not look like we are going to do anytime soon. Something tells me you have plenty of time to build up a bit of a position as we are forming a basing pattern.