Lothar Heinz Wieler, the President of the Robert Koch Institute (RKI), blames negligence for the rise in Covid-19 infections across Germany. The federal government advised citizens not to travel to certain parts of Spain, as the pandemic is expanding. Germany is hailed for its relatively low death count, which may have contributed to the public and the government to take a more relaxed approach. The summer months were forecast to see a slowdown in infections before a second wave will emerge during the regular flu season. Covid-19 cases have spiked to daily records, confirming that most assessments were incorrect. The DAX 30 recorded a lower high before entering a new breakdown sequence, likely to accelerate.

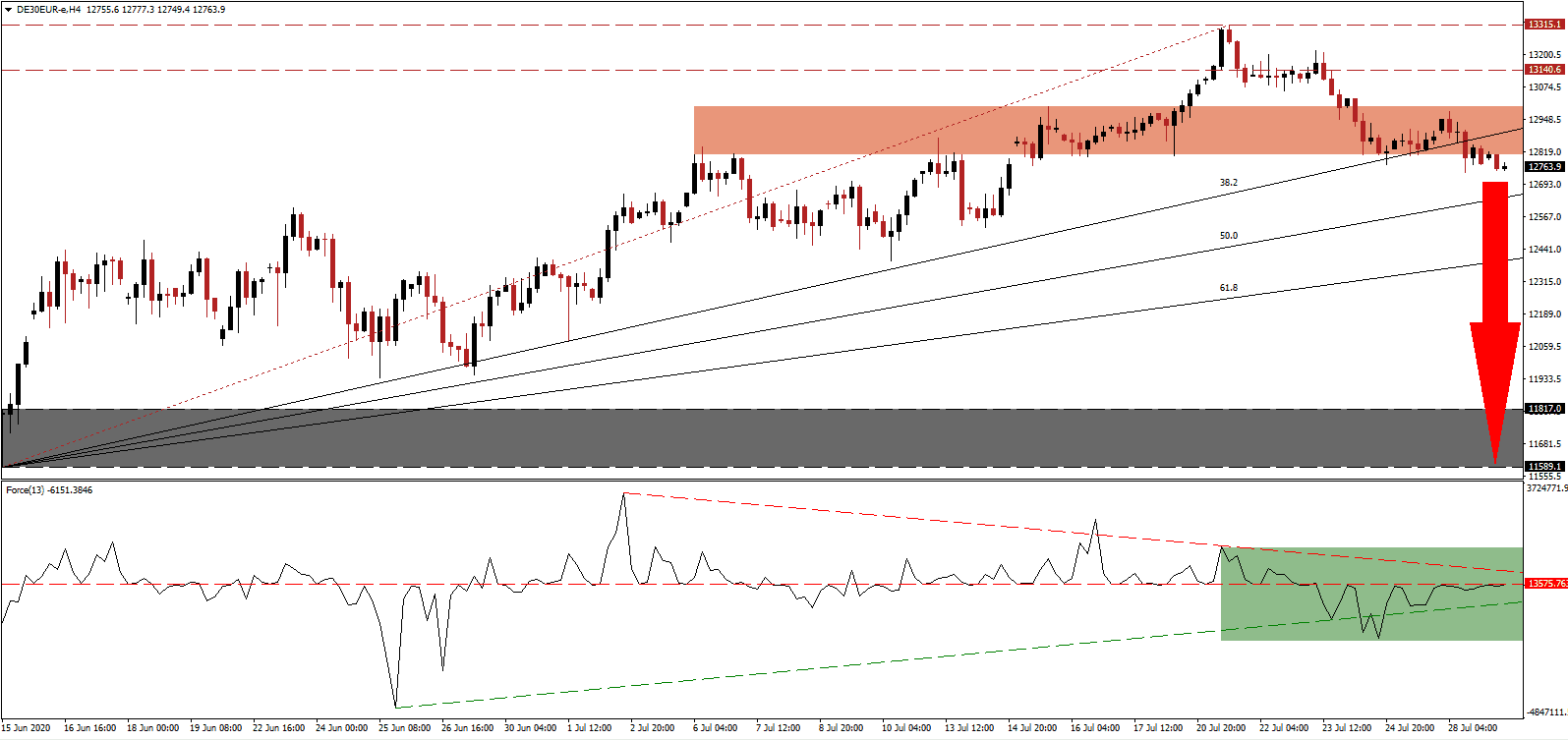

The Force Index, a next-generation technical indicator, maintains its position below the horizontal resistance level. Adding to downside pressures is the descending resistance level, as marked by the green rectangle. A collapse below its ascending support level will take this technical indicator more profoundly into negative territory and farther away from the 0 center-line, confirming bears are in full control over the DAX 30.

German manufacturing firms remain cautious, revealed by the Monthly Report of the Bundesbank. The central bank cautioned against a significant second-quarter GDP contraction, exceeding previous estimates. Adding to the moderately bearish outlook is the slow anticipated economic recovery. With the Covid-19 pandemic expanding, a double-dip recession cannot be excluded. The DAX 30 completed a double breakdown and is presently drifting away from its short-term resistance zone located between 12,808.6 and 12,998.6, as identified by the red rectangle.

Given the delayed economic reports, the Bundesbank constructed a new weekly activity index (WAI). Economic activity appears to have reached a bottom in May, but the central bank stressed that the WAI was in distinct depressive conditions as of mid-July. Job losses increased despite the short-time work scheme. A breakdown in the DAX 30 below its ascending 50.0 Fibonacci Retracement Fan Support Level is favored to force a collapse into its support zone located between 11,589.1 and 11,817.0, as marked by the grey rectangle.

DAX 30 Technical Trading Set-Up - Breakdown Acceleration Scenario

Short Entry @ 12,765.0

Take Profit @ 11,590.0

Stop Loss @ 13,030.0

Downside Potential: 11,750 pips

Upside Risk: 2,650 pips

Risk/Reward Ratio: 4.43

A breakout in the Force Index above its descending resistance level may result in a brief reversal in the DAX 30. Trades should take advantage of any price spike with new net short positions. Aside from the Covid-19 pandemic, the early stages of what is referred to as Cold War II, this time between the US and China, creates downside pressure on global trade. Germany remains an essential export-oriented economy with a focus on Asia and China as its base. The upside potential of a reversal remains confined to the intra-day high of 13,315.1, the top range of its resistance zone.

DAX 30 Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 13,145.0

Take Profit @ 13,315.0

Stop Loss @ 13,030.0

Upside Potential: 1,700 pips

Downside Risk: 1,150 pips

Risk/Reward Ratio: 1.48