The Euro has gone straight up in the air over the month of July, finally breaking out and changing the overall trend. With that being the case, it is not a huge surprise to suggest that I find myself bullish of this currency heading into the month of August. That being said, you cannot simply just jump in and start buying randomly. I think it is extraordinarily dangerous to do so after the last couple of weeks that we have printed.

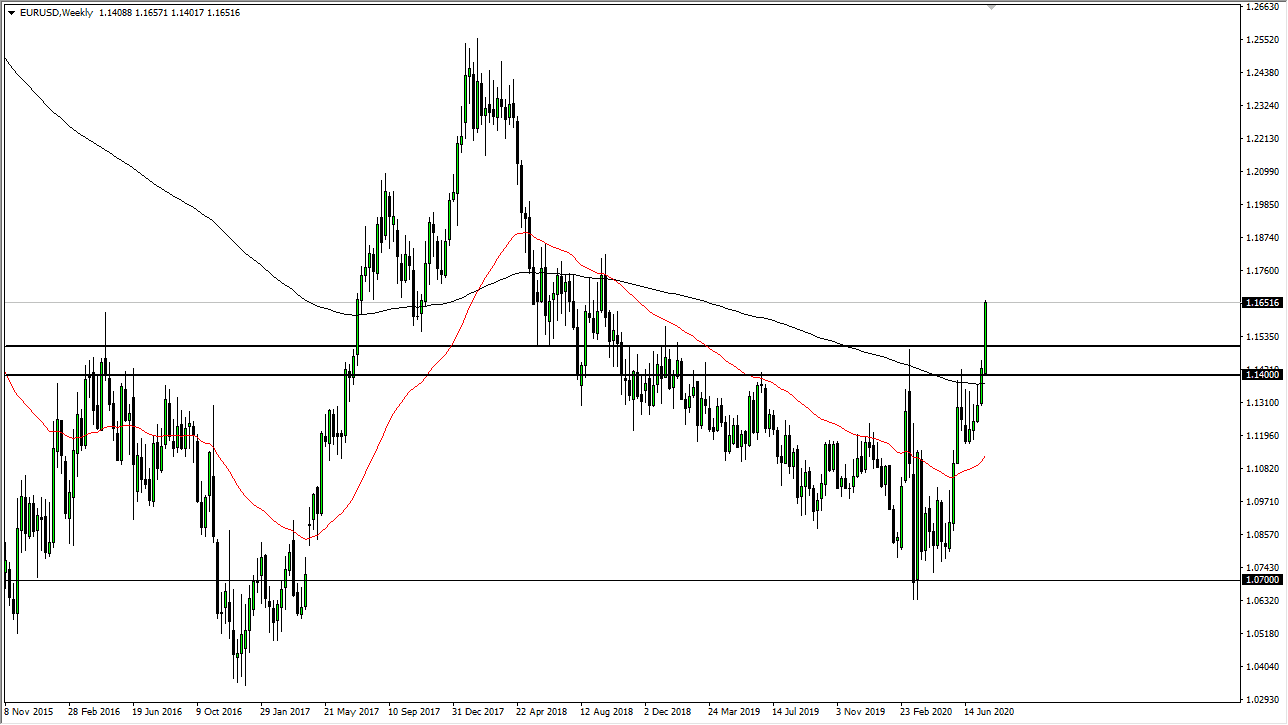

I have never seen a breakout that has not retraced sooner or later to test the previous resistance as support. Sometimes, it takes several months but most of the time it is a much quicker affair. I think that we will see a retest of the 1.15 level sometime during the month of August, perhaps even right at the beginning. That for me is when I would step in and start buying this pair, because breaking above the 1.15 level is always going to be difficult, yet we have found ourselves above there and quite drastically so heading into the month.

It should also be noted that the 200 week EMA is sitting just below the 1.14 level, which was the beginning of resistance extending to that crucial 1.15 handle. Because of this, I like the idea of using that as a “zone of support” that we can take advantage of. In fact, if you look at the weekly chart you can see that there were several wicks that formed on shooting star like candlesticks only to get broken above late in the month of July. This shows a complete collapse of the downward pressure, and as the Federal Reserve continues to flood the market with cheap US dollars, it makes sense that people run towards other currencies. In fact, I do not even know how much of this has to do with the Euro although it should be noted that the main push higher was after the 27 European Union countries agreed to a basic framework of coronavirus stimulus. Regardless though, the US dollar has been getting hammered against almost everything else and as the Euro is essentially the “anti-dollar”, I think we will see more of the same. Look for pullbacks as a potential buying opportunity and when I think will be a longer-term move towards the 1.20 level over the next several months.