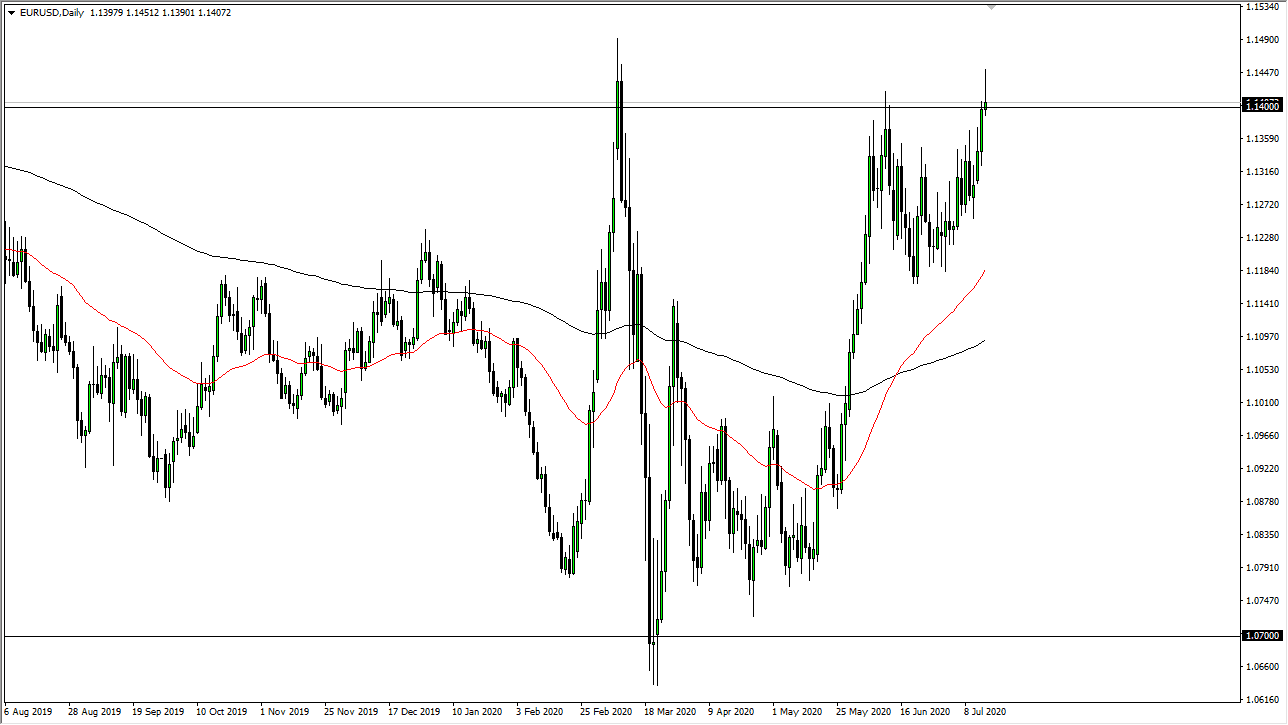

The Euro broke through the 1.14 level during the trading session on Wednesday, an area that has been a massive barrier. The fact that we broke through there was rather impressive and it does suggest for example that we could go all the way to the 1.15 handle. It is at that point where we then have to look at the Euro as having bottomed, and that longer-term trend is starting to work its way into the environment.

The Federal Reserve continues to kill the US dollar anyway it can, so this should not be a huge surprise. The Euro is the easiest way to express an anti-dollar opinion, so it is one of the first places that traders will go if they want to short the greenback, the second being the gold market. Both of those look very bullish but did get a bit of a pushback later in the day. I think this is probably more or less going to be thought of as clearing out a lot of overhead supply so that the market can continue to go higher.

Although I cannot necessarily suggest that I think the European Union is the greatest place in the world to invest, the reality is that the Euro is benefitting from the fact that the United States cannot seem to get the coronavirus situation together. If that continues to be an issue, then the United States will certainly lack the EU, and I think that is most of what is going on with this currency pair. On a pullback from here, we could see a move all the way down to the 1.1350 level, but I think somewhere in that area you would start to see buyers reenter the trade as we have seen such a major breach higher. Quite frankly, this market chopped its way higher for quite some time, and that is actually a much better sign for the buyers than it was the last time we were up here when it was a straight shot up in the air. This means that there is a bit more fundamental and long-term focus on the Euro rallying, which gives the idea of the trade working out a much better higher percentage. I look at dips as buying opportunities and I look at a move above the 1.15 level as a trend change.