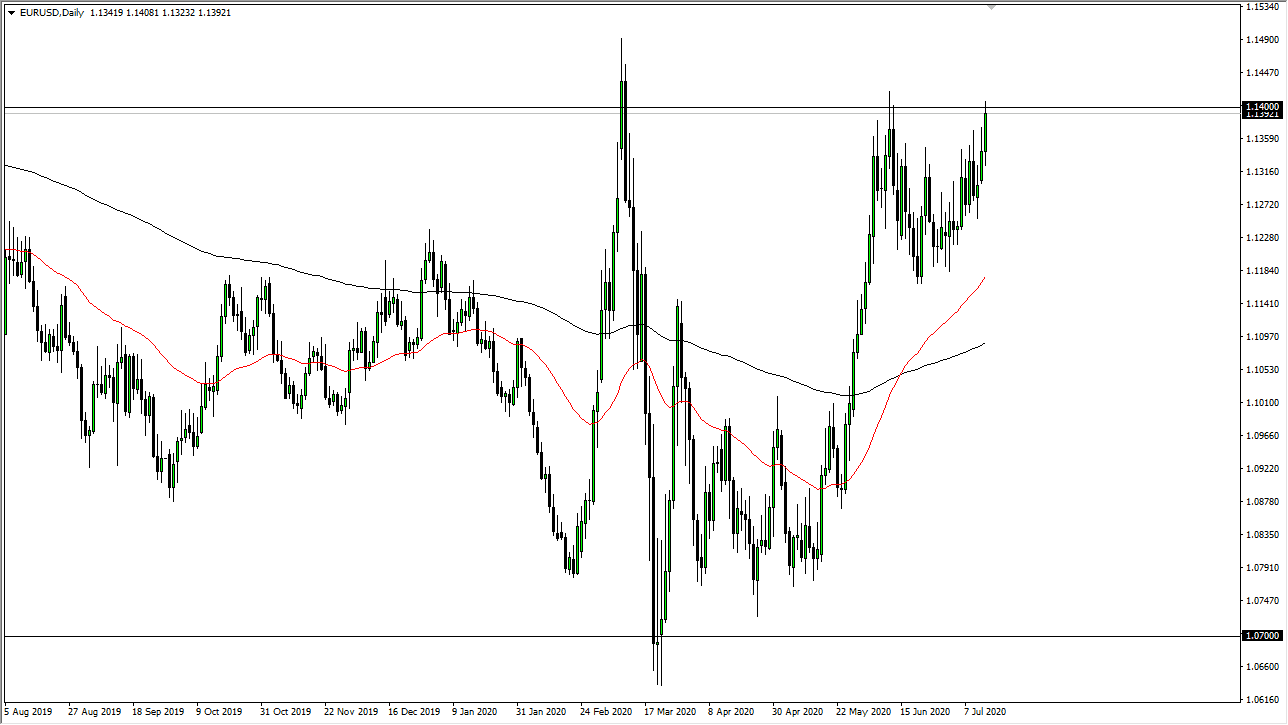

The Euro rallied during the trading session, challenging the 1.14 level yet again. Unlike the last several sessions, the Euro managed to pierce that level, so obviously we are making a little bit of headway here. However, when you look at the longer-term charts there is a massive amount of trouble just waiting above between here and the 1.15 handle, so I think that it is only a matter of time before this market pulls back again.

There are a couple of different things going on here, one of which is the Federal Reserve and its quest to destroy the greenback. As they continue to flood the market with liquidity, this obviously works against the value of the currency in the United States, and that is what you are seeing here. All things being equal though, we are a bit historically cheap when it comes to the Euro as well as many other currencies, so there is some room to run here.

The 1.14 level continues to be a major problem for buyers. I would anticipate that there still will be a significant amount of downward pressure, so at this point, I think a pullback makes quite a bit of sense. If we did break above the top of the candlestick from the trading session on Tuesday, that would have the market digging into even more of the resistance above that is so prevalent. To the downside, if we do break down it is likely that we will find plenty of buyers closer to the 1.12 handle, as we have been trying to form some type of overall range. Keep in mind that this is a pair that likes to grind and chop, so it would not be a huge surprise to see that take quite some time.

With this, I think that we are going to try to stay within the range that we have been in, but obviously some type of economic shock could send traders jumping in one direction or the next. If we manage to break above the 1.15 handle, then I think we have a real possibility of a move towards the upside for a trend change, but right now I am not ready to make that call. With that being the case, I think we probably get a little bit of a short-term pullback.