The Euro rallied quite significantly during the trading session on Monday to kick off the week, as there was a definite “risk-on” attitude around the world. This was kicked off by the Chinese equity markets skyrocketing overnight, as the Chinese came out and had a few choice words for the market to try to boost them. That said, people are selling the US dollar in general, so there was a bit of a “knock-on effect” over here in the Euro as well.

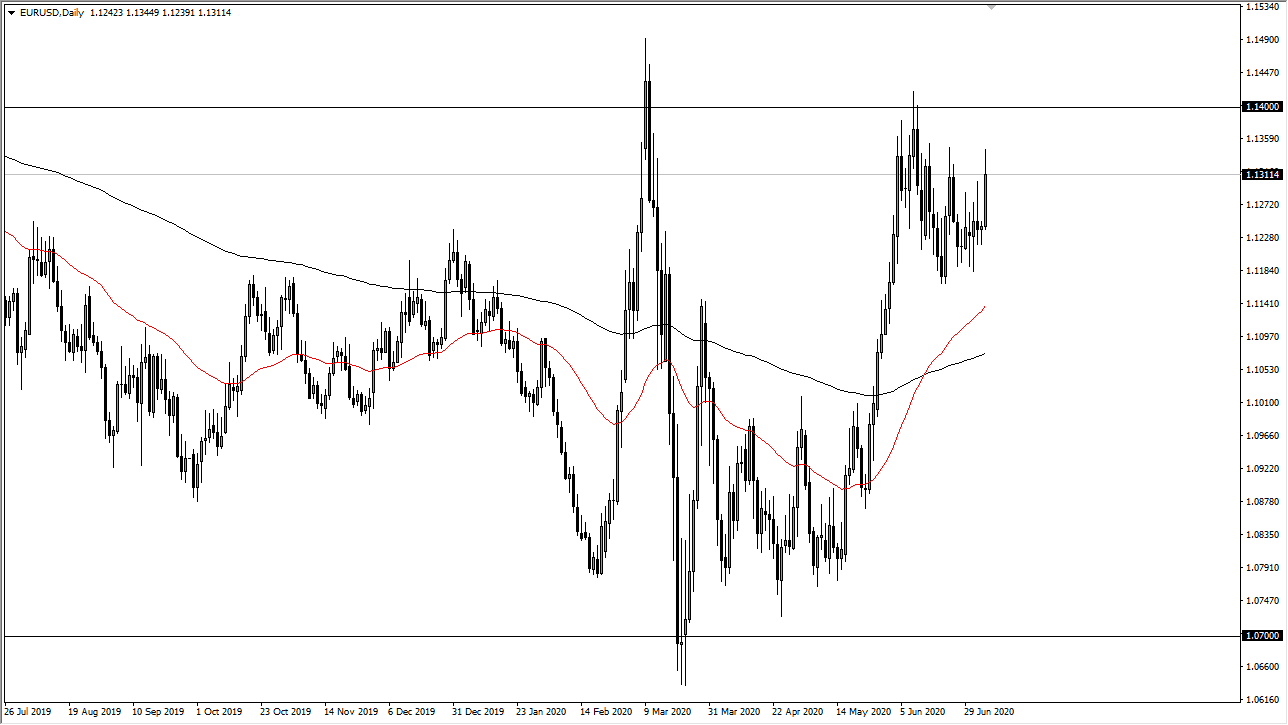

When you look at this chart, you can clearly see that there has been a lot of resistance just above, and although the candlestick for the Monday trading session is very bullish, the reality is that we could not break out and into the major resistance level above. That level extends all the way to the 1.15 handle above and it is probably only a matter of time before the market rolls over and starts to break back down again. If that is going to be the case, then I do believe that the 1.14 level will continue to be massive resistance that extends all the way to the previously mentioned 1.15 handle, and it seems like there is a ton of supply for Euros in that general vicinity.

I think we are trying to find the next consolidation area, which right now looks likely to be between the 1.12 level on the bottom and the 1.14 level on the top. If we break down below the 1.12 handle, then it opens up the door to the 1.10 level underneath, which is just below the 200 day EMA as well. This is a market that I think continues to see a lot of support in that area, but that could open up the possibility of a move down towards 1.07 level which was a major floor as of late. With that being said, the market is likely to continue very choppy behavior, but I do think that we will eventually see sellers come in and push this market lower. If we somehow break above the 1.15 handle, then I would become more of a “buy-and-hold” type of investor in the Euro. Until then, I think it is easier to short this market on signs of exhaustion like we started to see late in the day on short-term charts.