The Euro had an explosive trading session during the day on Tuesday as we initially dipped. The 27 leaders in the European Union agreed to the basic framework of a coronavirus stimulus package that was more or less with federal eyes, which was a huge change in the attitude of the European Union. After all, this is a group of people that hardly ever get anything together, let alone agree on anything. That being said, we still have some time to go and some work to do before this money gets approved through the various stages and distributed, but it is most clearly a very bullish sign for the future of the European Union, at least at the moment.

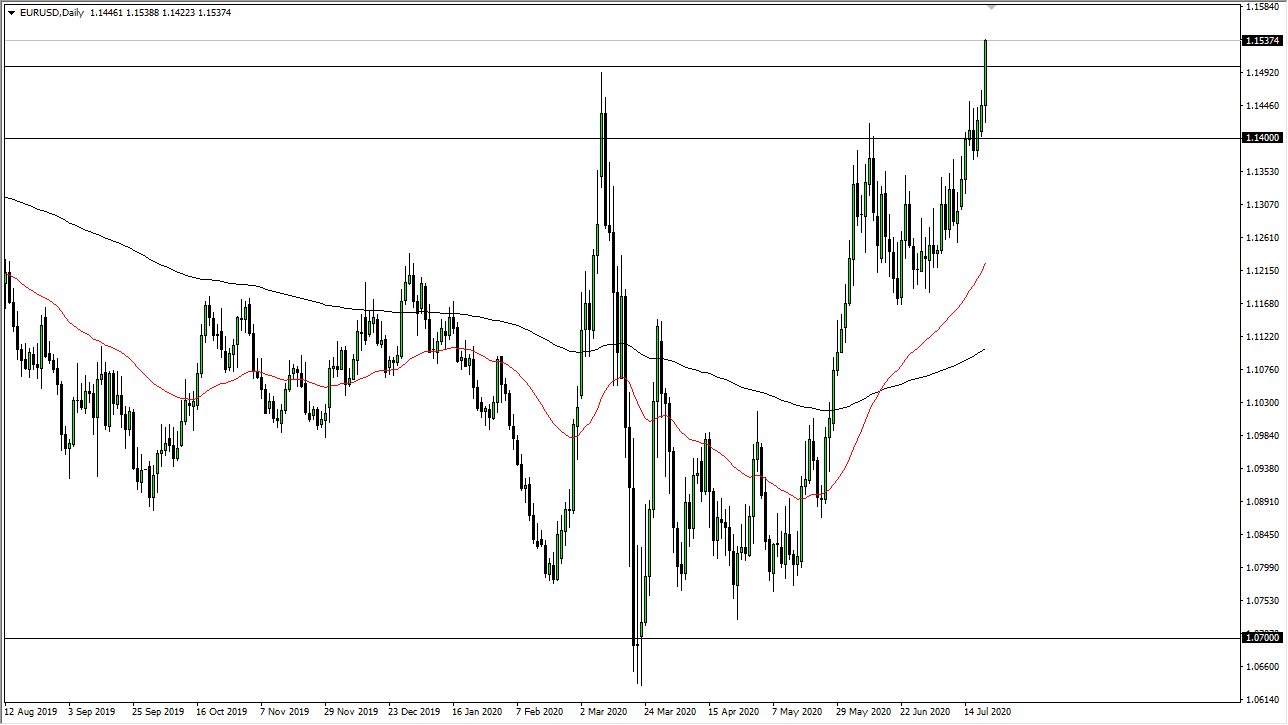

From a technical analysis standpoint, we just broke above the crucial level in the form of the 1.15 handle. The 1.14 level underneath was the previous resistance barrier that extended all the way to the 1.15 handle. We wipe that out now, so if and when we pullback in the short term, it is very likely that we will find buyers underneath. The 1.14 level should be your new “floor” in the market, and as a result, I think we have just changed longer-term trends.

Based upon the bullish flag that broke a couple of weeks ago, this market should theoretically go looking towards the area just below the 1.20 level, which could open up a longer-term move. The length of the candlestick is rather impressive, but it’s where we were breaking out that is much more important. At this point in time, I believe that the Federal Reserve doing everything he can to flood the markets with liquidity has finally taken its toll on the US dollar from a longer-term structural standpoint, and now the Forex markets are simply looking for where they can find growth, not necessarily where they can find frugality. All central banks around the world are very loose right now so it is essentially the same thing everywhere. With that being the case, it makes sense that this simply relies upon the Federal Reserve more than anything else and the prospect of the European Union healing its economy a little quicker than the United States. All things being equal I like the idea of buying pullbacks going forward and I think that we will go much higher.