EUR/USD: Higher prices very likely

Yesterday’s signals produced a nicely profitable long trade entry from the bullish doji candlestick on the hourly chart which rejected the support level identified at 1.1517.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered between 8 am and 5 pm London time today.

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1625 or 1.1685.

- Put the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1565 or 1.1517.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

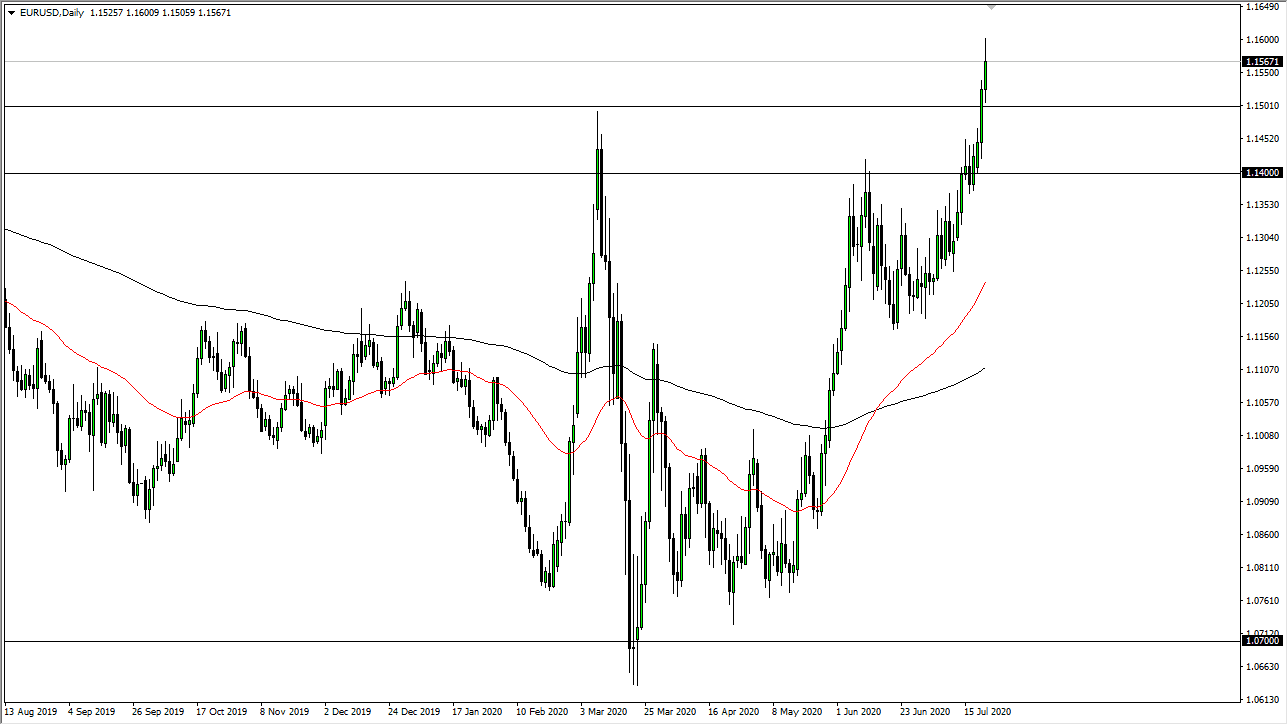

EUR/USD Analysis

I wrote yesterday that there was no reason not to be bullish as this currency pair tends to advance for a while after showing above-average volatility such as we have just seen. Therefore, a long trade from a bullish bounce at 1.1517 I thought was an attractive prospect.

This was a great call as there was a bounce at that level and the price has continued to rise to new long-term high prices.

The situation continues to look bullish, with new higher support at 1.1565 and the price rising firmly over the short term.

We are likely to see another test of the high made earlier at the round number at 1.1600.

These prices have not been seen for 18 months. We have a strong, long-term bullish trend with momentum.

I am very happy to take a bullish bias here, looking for trades from bounces at support following retracements. Scalpers can try to enter on dips without worrying about whether exact support levels are reached.

There is nothing of high importance due today regarding either the EUR or the USD.