For the fourth consecutive day, the EUR/USD continues to correct upward with gains that pushed it towards the 1.1370 resistance, its highest level in a month, where it is stable around at the time of writing. Euro gains were not as strong as the rest of the currencies against the dollar, given the pessimistic forecasts issued by the European Union during the Corona era. At the same time, the European economic stimulus plans are still under study and consultations. Since the beginning of the German presidency of the current European Union cycle, it has always urged the approval of these plans to accelerate the revival of the European economy. Yesterday, German Chancellor Angela Merkel said that the COVID-19 pandemic showed the limits of “populist denial of the truth.” She urged European Union countries to quickly agree on a major economic recovery package and deny nationalists any chance to benefit from the crisis.

The virus has killed more than 100,000 people in 27 European Union countries. This sparked what is likely to be the worst economic crisis in Europe in nearly a century, according to the European Commission, after the disease destroyed health care systems and forced countries to close companies, transport systems and schools. Merkel's comments to the European Parliament came as she urged the leaders of Italy and Spain - the first European Union countries to impose long-term closings and two of the most affected countries in the world - their fellow members of the European Union to agree at a summit next week on "ambitious conditions" for the recovery fund to help get economies back on the right track.

Merkel told lawmakers, "The depth of the economic downturn that requires us to accelerate.", “We must not waste time - only the weakest will suffer from this. I very much hope that we can reach an agreement this summer. This will require a lot of willingness to compromise from all sides - and from you too. ” she added.

On the other hand. US stock markets continue to rise even as the second coronavirus wave continues to threaten to derail the economic recovery, largely due to the popularity of technology stocks that have benefited from the business model's resilience to the harmful effects of the closure measures used to contain the virus. If US stocks continue to perform well, the dollar may be at risk of further collapse and a return to its lowest level reached in March against the major currencies, although there are no guarantees on that, any declines in the markets are likely to raise the value of the dollar as a safe haven.

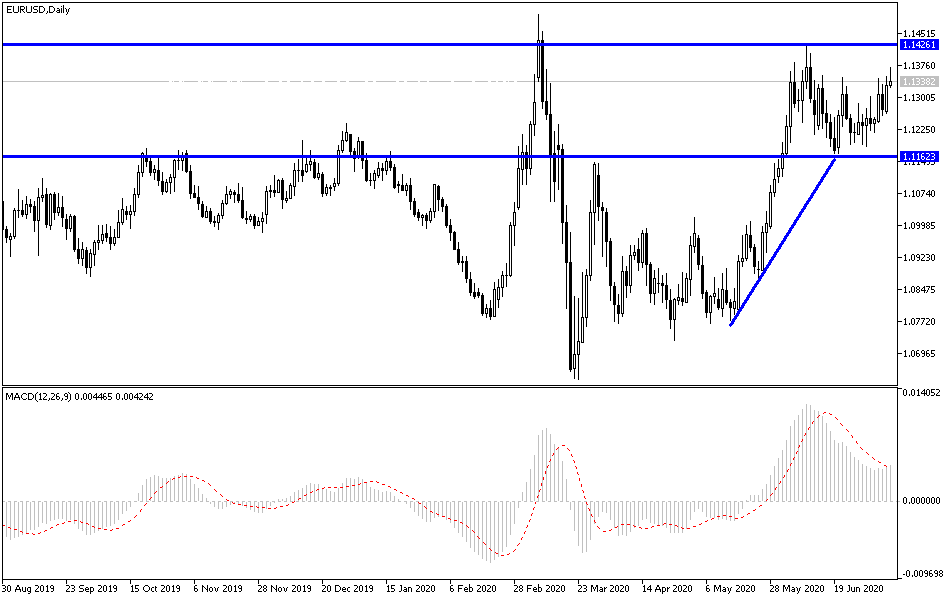

According to the technical analysis of the pair: Despite the EUR/USD recent attempts to correct higher, it still faces obstacles to make the rebound stronger, and may succeed in reversing the general trend upward if it moves towards the resistance levels 1.1425, 1.1500 and 1.1585, respectively. On the downside, stability below the 1.1300 support will continue to support the bear's control, as is the case on the long term. It must be taken into account that the Euro’s performance will remain in a limited range in anticipation of the crucial announcement regarding the adoption of European stimulus.

As for today's economic calendar data: From the Eurozone, the German Trade Balance will be announced. Then, we have the number of weekly US jobless claims.