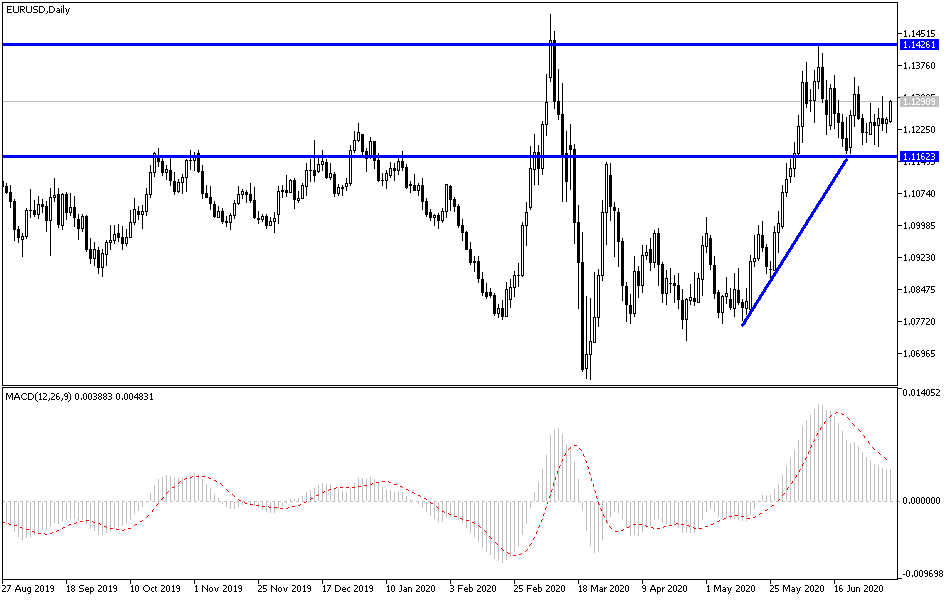

For several consecutive trading sessions, the EUR/USD pair moved in a limited range, technically waiting for a price explosion in one of the two directions, with the closest being to a continuation downward. For two weeks in a row, the pair could not overcome the 1.1325 resistance, with the lowest support level was at 1.1184, and it closed last week's trading around the 1.1248 level. As we expected before, the single European currency lacks incentives for an upward correction due to the lack of European stimulus in the face of the pandemic, unlike the United States of America, which approved huge and continuous stimulus plans.

With Germany taking over the presidency of the European Union, German Chancellor Angela Merkel called on Friday for a speedy agreement on a recovery fund aimed at pulling the European Union out of the stagnation caused by the Coronavirus, arguing that "every day matters." Germany, which has the largest economy in the European Union and, the largest country in terms of population, assumed the rotating presidency of the European Union for a six months period, starting last Wednesday. This gives it a major role in flattering others in the 27-nation bloc to make concessions on the recovery fund and EU budget for the next seven years - ideally when EU leaders meet on July 17-18 at their first face to face summit in months.

European Commission President Ursula von der Lin called Merkel and senior European Union officials for a meeting on July 8 to "assess progress" and prepare negotiations.

"The path is difficult and a lot of goodwill and a willingness to make concessions from all sides will be required to achieve our goal," Merkel told the Senate in the German parliament in a speech outlining its priorities for the presidency of the European Union. "But in light of the current economic development, the time is pressured and every day is important." In May, Merkel and French President Emmanuel Macron proposed the creation of a one-time recovery fund of 500 billion euros (563 billion dollars), which would be filled through joint borrowing from the European Union.

The European Union executive commission has expanded on the proposal, and has put forward plans for a 750 billion Euro fund mostly made up of grants. The fund faces resistance from countries that are being called "Frugal Four" - Austria, Denmark, the Netherlands and Sweden - who oppose grants and refuse to give money without restrictions. In this regard, Merkel said: "The situation is exceptional, so it requires extraordinary effort." She added that working for a strong, economically and socially united Europe "is also a decisive political tool against the populists and against the anti-democratic forces and the radical and authoritarian movements."

From the United States, President Donald Trump on Saturday signed a temporary extension of a program to support small businesses affected by the coronavirus, and the legislation extends the June 30 deadline to apply for the program until August 8. Lawmakers created the program in March and amended it twice since then, adding funds on one occasion, and more recently allowing more flexible use of funding despite some grumbling among the Conservative Republican Party. About $130 billion of the $660 billion approved for the program is still eligible for companies to obtain direct federal support for payroll and other costs such as rent, although demand for the salary protection program has decreased significantly in recent weeks.

The Democratic-controlled House of Representatives voted last Wednesday to approve the extension of the program after the Republican-controlled Senate did the same.

According to the technical analysis of the pair: There is no change in my technical view of the EUR/USD, as the stronger general trend is downward, especially if it stabilizes around and below the 1.1200 support. Because it will support the move towards 1.1165 and 1.1080 support levels. Without the breach of the 1.1400 resistance, there will be no strength to correct higher. The price explosion is very likely after the pair's recent performance. Merkel's success in persuading all European leaders to pass the stimulus plans will cause the explosion to climb strongly. Or vice versa if it fails.

As for the economic calendar data today: First, German factory orders and retail sales for the Eurozone will be announced. From the United States ISM services PMI will be released.