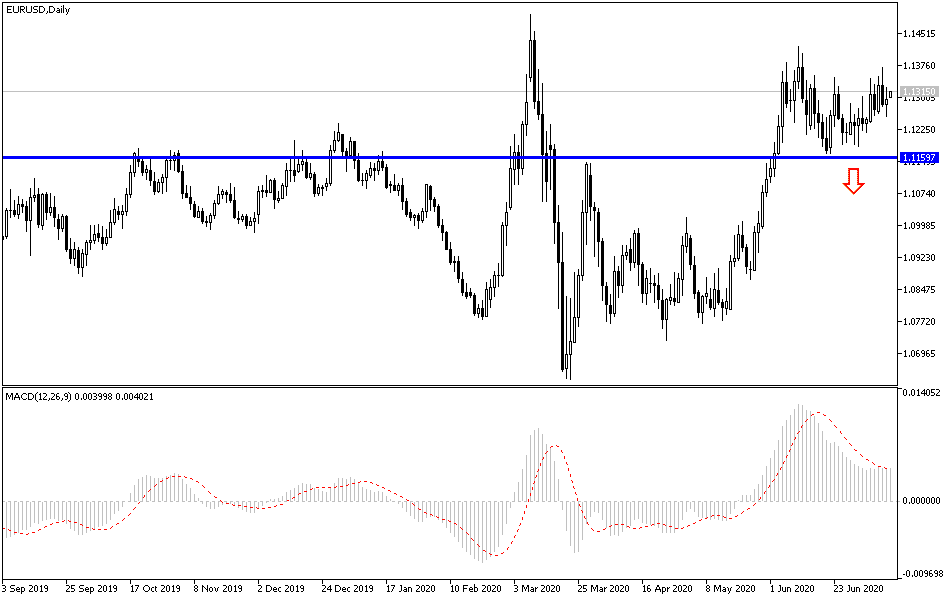

Throughout last week’s trading, the EUR/USD pair attempted to exploit investors giving up the USD despite fears of new Coronavirus cases. Therefore, the pair succeeded in moving towards the 1.1370 resistance. The pair failed technically to overcome the 1.1425 resistance, which is important for bulls controlling the performance, confirming the pair losing more momentum to reverse the trend.

Despite this performance, there are still expectations of a strong recovery for the pair during the second half of the controversial 2020. A number of analysts see the possibility of a weak dollar performance in the second half of 2020 based on the possibility of a global economic recovery. But others warn that the Euro’s ability to advance further will depend on whether the European Union passes its fund aimed to recover from the epidemic crisis sometime in the near future, as this week’s meeting of European Union leaders at the European Council is seen as an important milestone for the future of the Euro’s performance.

European Union leaders will meet to try and reach an agreement on what the rescue fund for the next generation of the European Union will look like, and most currency market analysts expect the fund ambitious to falter in the face of European Union economic opposition led by the Netherlands.

Sentiment towards the Euro has improved in recent weeks after the European Commission proposed a 750 billion Euro bailout fund that will provide loans and grants to European Union countries and viable companies to include the region's recovery from the crisis caused by the Coronavirus. The required borrowing to finance loans and grants will be secured by all European Union countries, which some large financial countries have objected to.

The key to the EUR expectations is how similar the final package is to the current proposals, with more potential gains if only minor changes are adopted. The chances of the plan’s success are likely to be identified at the European Council meeting scheduled for July 17-18, as markets want to make some substantial progress if the Euro wants to sustain any of its recent gains.

“It is very important for the European Union and the Euro that the July 17-18 summit includes discussions on the European Union recovery fund,” says Thomas Florey, UBS bank strategist. “We see a great opportunity for progress, which would bring the gains to the Euro” he added. The Euro is likely to benefit if the final package is as close as possible to the current proposals, and the summit is likely to see "confronting the four economies" which includes the Netherlands, Austria, Denmark, the Netherlands, and Sweden vis-a-vis Germany, France, Spain, and Italy.

According to the technical analysis of the pair: On the daily EUR/USD chart, there is some neutrality in recent performance, although the strongest tendency is downward, especially if the pair settled below the 1.1300 support. Bears will gain strength in performance if they move towards support levels at 1.1225 and 1.1180 respectively. On the other hand, the bulls are waiting to pass the resistance barrier at 1.1425 to get the pair out of the current downward swamp.

Today, the pair does not expect any important economic data, whether from the Eurozone or the United States of America.

Later this week, the Euro will react to the announcement of the European Central Bank monetary policy and indications about what is expected from the European summit, as well as a package of important US economic releases.