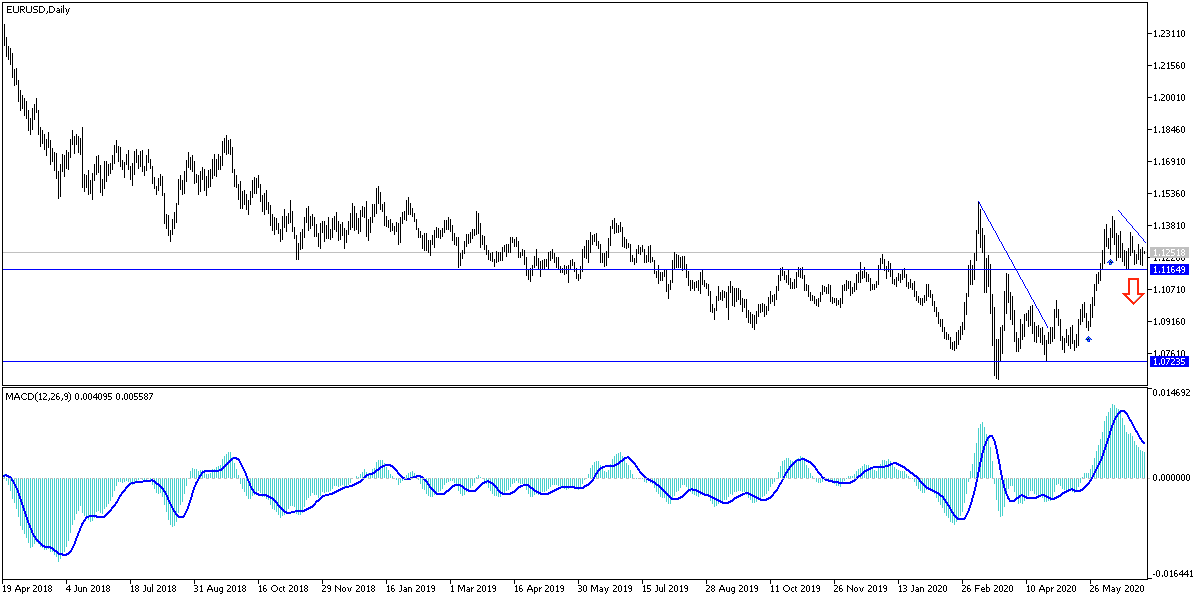

On the daily EUR/USD chart, it is clear that the bears are dominating the performance, and the chances of upward correction are weak, as the US dollar remains the safe haven currency for investors. This is amid threats of the global economy returning to closure with an increase in new coronavirus cases, which supports the idea a second wave of the epidemic is on its way. This would be disastrous for the global economy that is experiencing the largest economic recession since the thirties. Since the beginning of the week's trading, the Euro has remained stable between the 1.1185 support and the 1.1288 resistance, and has settled around the 1.1250 at the time of writing, and before announcing the details of the US Labor Department report that tracks the change in US jobs and wages for the month of June.

The single European currency traded under pressure against most other major currencies, as stock and currency markets took a detour away from risk, with safe havens, such as the Japanese yen and the US dollar, outperformed. Markets have reacted to fears that China will impose a controversial "national security law" on Hong Kong, which is believed to violate the "one country, two systems" model of the city management.

This comes after years of pro-democracy protests that angered Beijing. In this regard, British Prime Minister Boris Johnson said in a speech to the Parliament: "The enactment and enforcement of this National Security Law constitutes a clear and grave violation of the Sino-British Joint Declaration." "If China and the markets are right and the United States does not have the capacity to take real action on Hong Kong, then the risk is still running" he added.

The danger feared by the markets is the renewed confrontation between the United States and China over Taiwan as well, with the Chinese economic ties extend deep in the strong industrial economies in Europe, as was proven in the two years until 2020 when the bloc suffered greatly from the trade war between the United States and China.

Concerns about the response and the exchange of reciprocal measures between the United States and China, including what the media classifies as “foreign missions,” reflect escalating tensions between China and other countries in the world. The White House has repeatedly threatened revenge if China passes the National Security Law, while German Chancellor Angela Merkel said on Wednesday that she would press for a UN Security Council debate on human rights in China. But the United States has yet to say exactly what its response will be, while China is a permanent member of the UN Security Council and has the ability to veto its resolutions.

The German economy contracted less in the first quarter than its counterparts from global economies and less than half the pace of decline in the United States, while it is also believed to be less affected by measures to contain the COVID-19 in the second quarter. Differences in expectations for economic growth are important for exchange rates, and may be fundamental to whether the EUR/USD will move towards its best level in June right above 1.14, or slipping below that month's low around the 1.11 support.

According to the technical analysis of the pair: On the daily EUR/USD chart, there is some neutral performance with a greater trend towards completing the downward path, especially if the pair settled below the 1.1200 support. The closest support levels for the pair are currently 1.1185 and 1.1090 respectively. There will be no chance for an upward correction without crossing the 1.1400 resistance barrier.

As for the economic calendar data today: From the Eurozone, the producer price index and the unemployment rate will be announced. While the greatest interest will be for the American session data, which includes announcing the change in the US non-agricultural jobs number, the unemployment rate and the average hourly wage. Then the Unemployment claims, the Trade Balance and factory orders data will be announced. The announcement of the US data will be intensified today before the Independence Day holiday on Friday.