For the four trading sessions in a row, the EUR/USD is in the range of an upward correction that pushed towards the 1.1423 resistance in early trading today. This is its highest level in four months, before settling around 1.1395 at the time of writing. The pair's gains came in conjunction with rising tensions between the United States and China, and after German Chancellor Angela Merkel drew a line in the sand over negotiations regarding the European Recovery Fund before the European Union Council meeting on Thursday, which is the most important event this week and the most influential on the single European currency.

US Secretary of State, Mike Pompeo, defined a formal US rejection to Chinese territorial claims in the South China Sea, hours after a Reuters report showed the White House interest in Chinese companies listed in US markets, which had spoiled the mood of investors, who were suffering mainly from the increase in new COVID-19 cases.

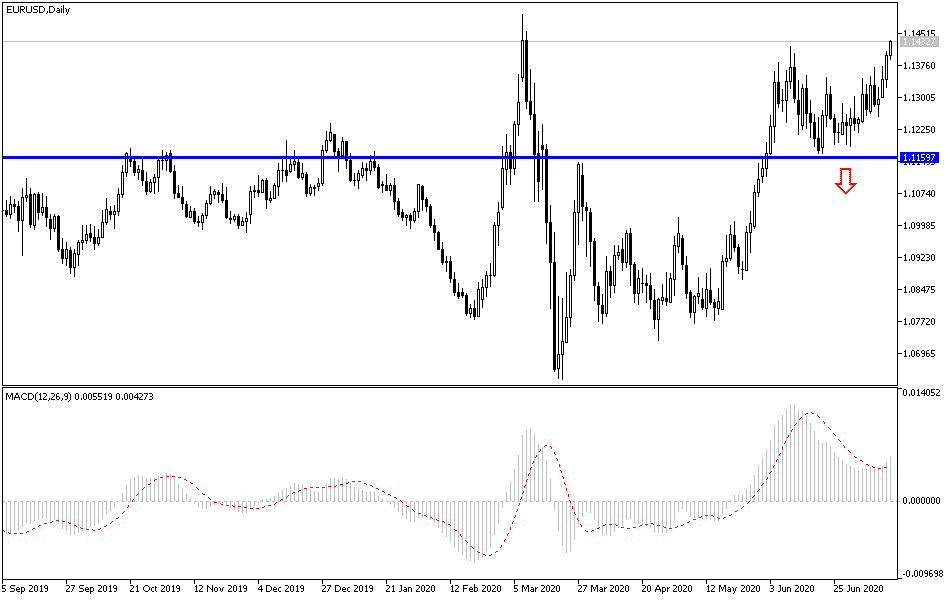

This was apparent among investors of stocks and many currencies after California announced new restrictions on the "closure" style of activity on Monday to cope with the high cases of COVID-19 infection. The flexibility of the Euro comes before the European Council meeting in particular, in which it’s hoped that some form of progress towards an agreement among member states will be achieved. Analysts believe that passing this agreement will increase the Euro’s gains, even if that was in the medium term. In the event that the agreement fails, which is possible, especially after Merkel's recent statements, the EUR/USD pair will be vulnerable to a drop to the 1.1100 support.

In a statement after a meeting with Italian Prime Minister Giuseppe Conte, Merkel said that the so-called economical member states should not seek to reduce the volume of spending to recover from the coronavirus mentioned in the next multi-year budget of the European Union, and for his part, the new alternate president of the European Council said that it was not clear whether an agreement will be reached regarding the next multi-year budget for the European Union or the recovery fund, but he confirmed his willingness to negotiate its last structure.

The $750 billion grant and loan package is a major factor in recent improving sentiment towards the Euro, but it must get the unanimous approval of all members along with the budget for the next seven years. Analysts are concerned that objections from the Netherlands, Denmark, Sweden, and Austria to a $500 billion tranche financed by grants can dramatically reduce its size or turn them into a program that is heavily dependent on debt.

According to the technical analysis of the pair: As I mentioned earlier, that the success of EUR/USD in overcoming the resistance barrier at 1.1425 will be a catalyst for a bullish correction, and the current closest resistance levels that support stronger bulls control are 1.1495, 1.1550 and 1.1635 respectively, and the last level will be a coronation of the trend reversal. If the European summit fails to pass the expected agreement, the Euro may collapse quickly and it may return to the periphery of the 1.1100 support quickly. One must be cautious about trading the Euro until knowing what the important European summit will bring out this week.

As for the economic calendar data: From the United States, the Empire State Index and the industrial production rate will be announced. There are no significant economic releases from the Eurozone today.