A positive start to the EUR/USD price performance this week, as it moved towards the 1.1345 resistance, highest level in two weeks, before settling around 1.1315 at the time of writing, awaiting stronger stimuli. Gains were supported by the decline in the US dollar and a state of optimism prevailing in the markets after hints from German Chancellor, Merkel, under her country's presidency of the European Union that they would work at full strength to convince member states to agree to European stimulus plans in the face of the coronavirus effects. European Union finance ministers will meet last Friday to discuss this important file.

The Euro is still more than 4% higher than its lowest levels in late May despite falling from levels above $1.14 in early June, most of these gains were caused by the excitement over the European Recovery Fund proposals and the improvement in the global investor risk appetite. The European Union Commission’s quest for a 750 billion Euro private financial support package is a long and arduous path, as it still needs to win unanimous support from national leaders, with many lines of conflict between different member states over aspects of this proposal.

"We remain concerned that the market is overvaluing the Euro" said Athanasios Vampfakidis, head of foreign exchange strategy at Bank of America. He added: “For us, including grants, was the most important innovation in the recovery fund proposal and the essence of its political message, as it was a clear red line before. Weakening this part of the recovery fund and replacing it with loans will be the problem, in our view. European Union countries do not need more loans.”

Through French-German support, the European Union proposed providing 500 billion Euros of grants to some members of the Eurozone who are suffering the most from the closure policy to contain the spread of the epidemic, and this was a factor for sentiments towards the single European currency, in addition to 250 billion Euros in the form of loans. But the northern European countries insist on a larger share of loans in addition to a set of conditions for member states to obtain them. The demands of conditions attracted opposition from southern countries including Italy and Greece, while the current question mark expanded whether this fund could be approved. On the other hand, Chancellor Angela Merkel said last week that the fund is in a "rocky way", while the Dutch press quoted Dutch Prime Minister Mark Roti as saying that there is no need to conclude a deal this week, and that one can wait until the fall.

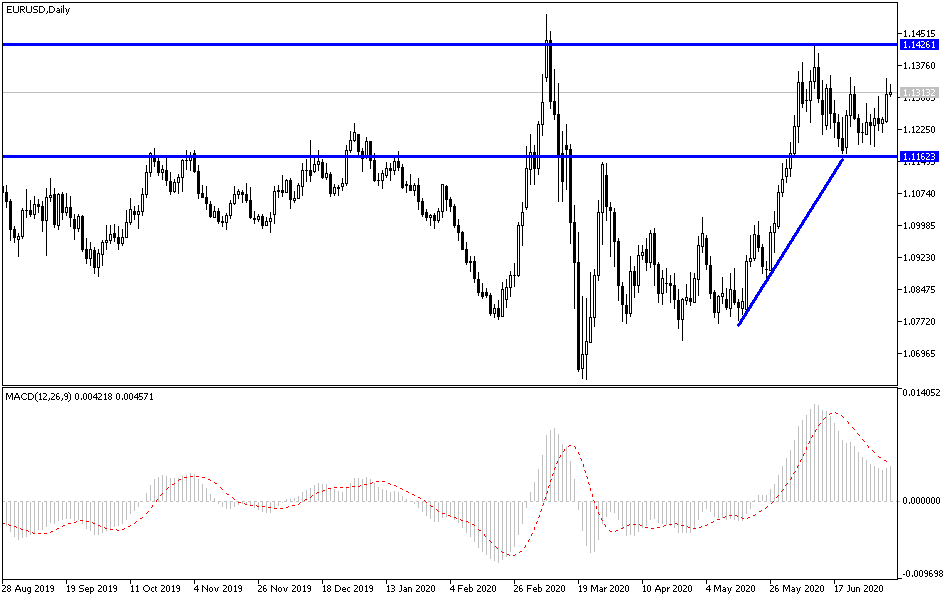

European Council President Charles Michel will publish a set of intermediate proposals on Thursday with the start of the Euro group finance ministers meeting, and there is a risk that the new plan will disappoint investors, and any major disappointment resulting from this week's meeting could be sufficient to undermine the temporary upward trend For the Euro, although technical analysts say that the price of the EUR/USD will remain on the track to retest its previous high above 1.14 as long as it remains above 1.1168.

According to the technical analysis of the pair: The recent EUR/USD bullish momentum needs to breach the 1.1420 resistance to confirm the strength of the pair’s bullish correction. On the other hand, the return of the move below the 1.1250 support will restore the bears control over the performance as is the case in the long run. The EUR/USD pair will continue to fluctuate until the end of this week's European meetings. In general I still prefer to sell the pair from every higher level.

As for the economic calendar data today: German industrial production and the French trade balance will be announced, and the U.S JOLTS jobs report will be released.