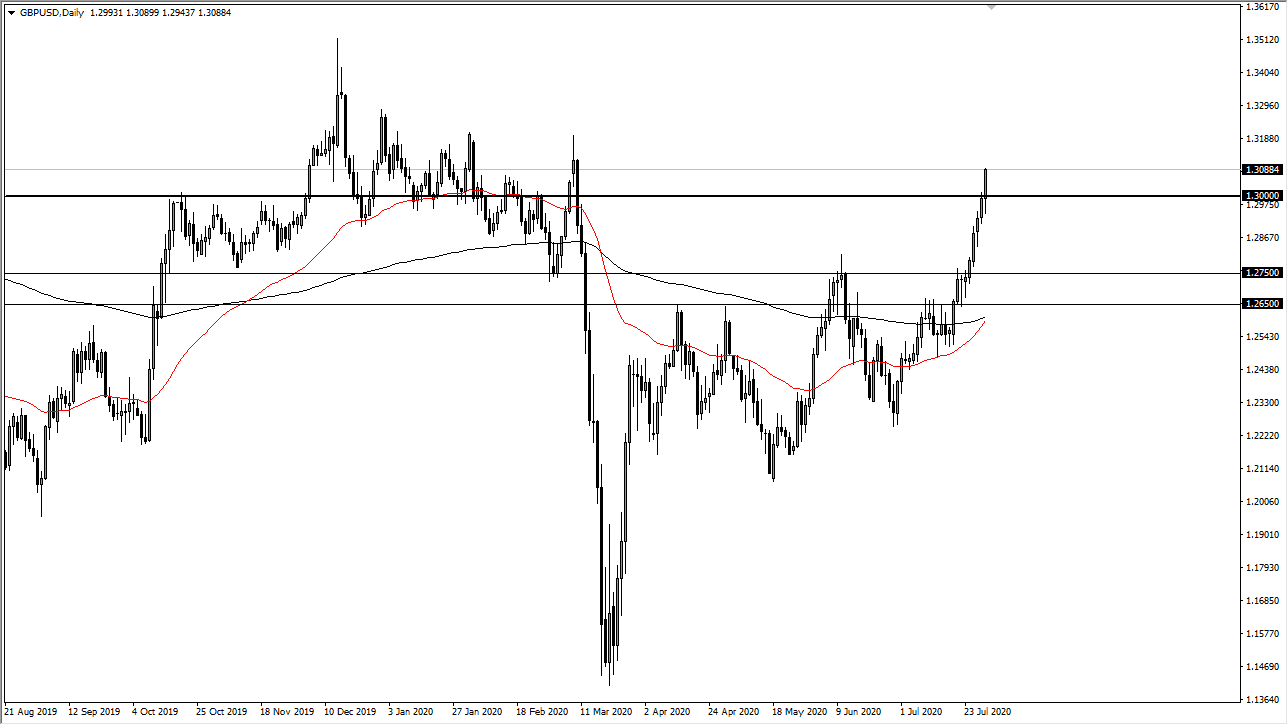

The British pound has shot straight up during the day after initially pulling back, as we have seen the US dollar get absolutely hammered. Ultimately, this is a market that I think is going to continue to go higher over the longer term, but we do need to pullback a little bit in order to find value. I have been saying this all week and I am tired of saying it, but it is the truth: you cannot buy the British pound when it is “expensive.” We could very well go to the 1.3150 level relatively quick, but at that point I think we face more troubles, especially as we go into the weekend.

I am interested to see how the 1.130 level acts if we try to reach back down there again. If we break down below there then it is likely that we go looking towards the 1.2750 level, an area that has been important more than once and suggests massive support all the way down to the 1.2650 level. All that being said, the fact that we are closing at the very top of the range for the session does speak volumes, and it suggests that we have further to go. As a general rule, when you close at the very top of the candlestick for the day some follow-through.

If we blast through the 1.3150 level like it is not even there, that is not good news. It shows that we had gotten far ahead of ourselves and it is difficult to imagine that the momentum can keep up in that type of situation. We want to see a nice uptrend, not some type of parabolic psychotic move like we have seen in other markets. The British pound seem to be completely ignoring the United Kingdom itself, which ironically desperately needs a cheaper currency to help the overall situation. Brexit is coming, and that will certainly have its say when it comes to the British pound as well, but right now it is all about the Federal Reserve when it comes to the Forex markets, and of course this pair is going to follow the lead of all the other ones out there as we continue to see massive US dollar weakness.