The British pound initially dipped a bit during the trading session on Tuesday but then rallied rather significantly. The market looks like it is ready to go looking towards the 1.30 level above, which is a large, round, psychologically significant figure. That has been a major target for some time and the fact that we are a bit parabolic does not really matter at this point. I think that this market continues to be a “buy on the dips” type of mentality. The 1.2750 level underneath is a major support handle, that extends all the way down to the 1.2650 level. That is a “zone of support” that is just looking to get involved in the market and support the pound.

That being said, if we were to break above the 1.30 level, it is likely that the British pound could continue towards the 1.3150 level, and I do think that happens eventually. However, I think that we are a little overbought at this point so it would make sense to see the pullback happen. If we can get some type of move lower, I am willing to jump all over the first signs of a bounce.

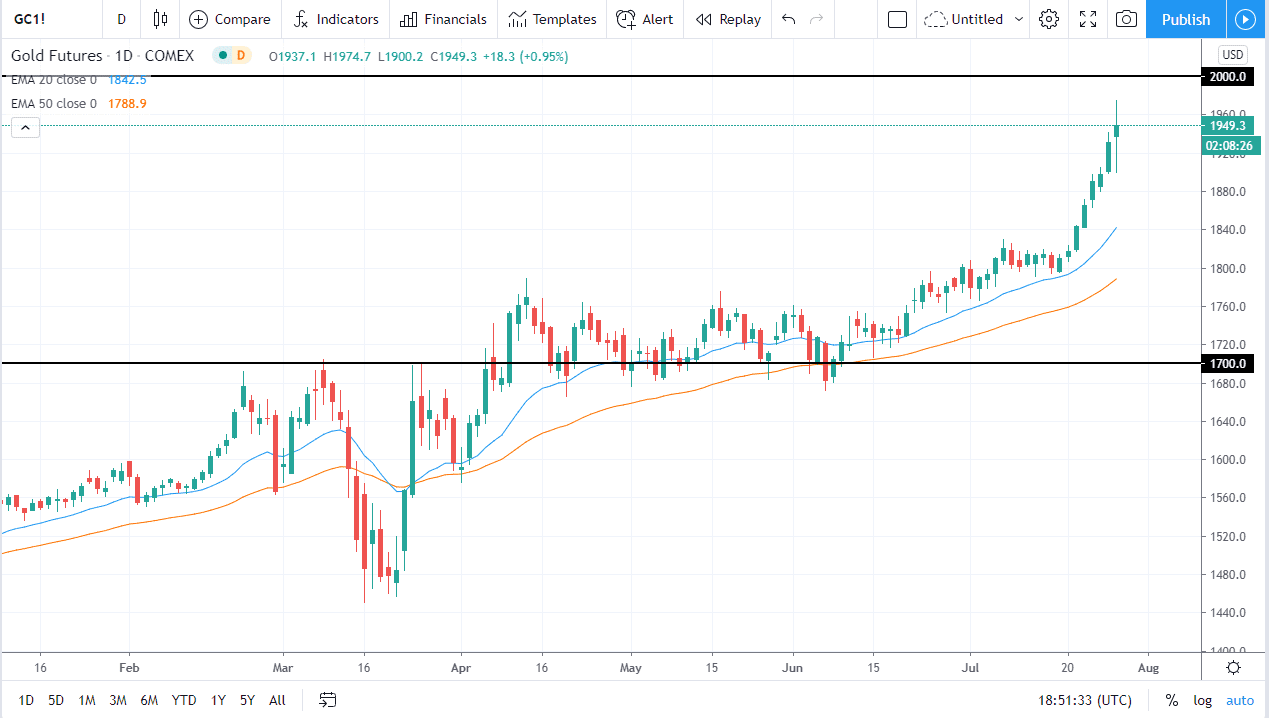

With the Federal Reserve and its quantitative easing causing so much chaos with the greenback, it is likely that the British pound will continue to find reasons to rally. To the downside, if we were to break down below the 1.2650 level that would be a major shift in attitude but I think that with the 50 day EMA getting ready to cross the 200 day EMA just below there, it is likely that we will see plenty of support to keep this market going higher. I like the idea of buying and holding but I also like the idea of buying at lower prices. I have been very cautious about putting too much into the trade-in one shot, so this is more or less going to be a “add as you go” type of market. At this point, I have no interest in shorting this market anytime soon because I think the trend is changing for the long term, maybe not in favor of the British pound, but more of an anti-US dollar type of trading situation. We are not crazy about the British pound, but we know better than the hold US dollars right now.