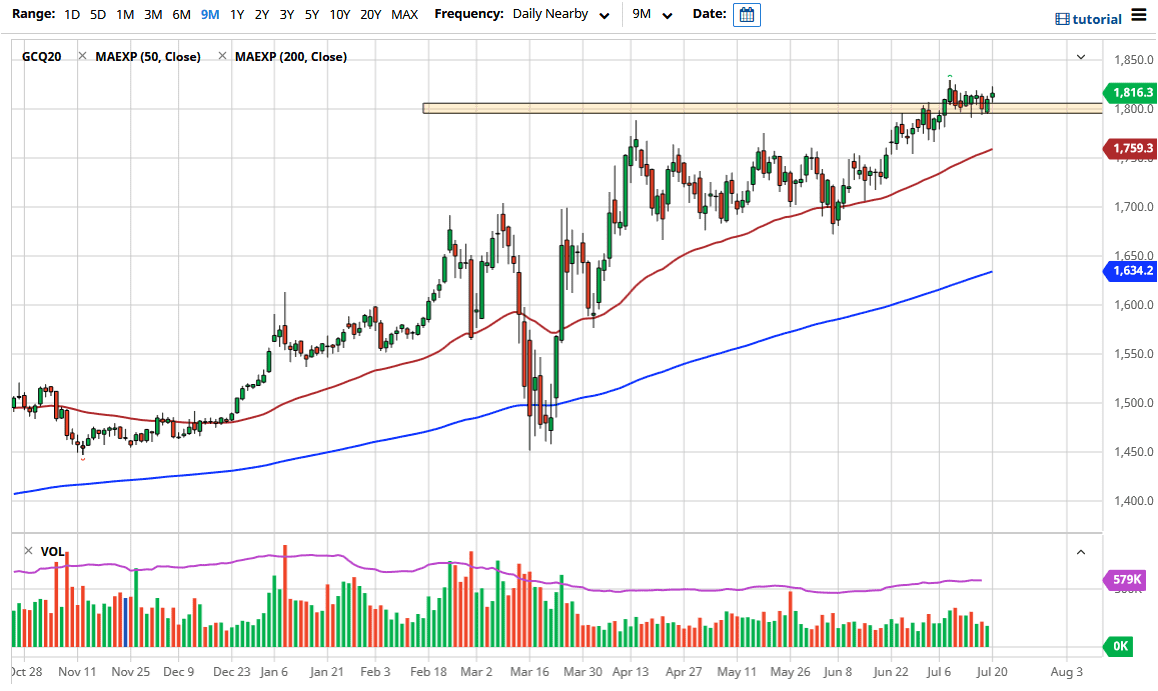

Gold markets initially gapped higher to kick off the week, but then pulled back to fill that gap and look for buyers underneath. By turning things around the way, we have, it looks highly likely that the market is going to continue to grind towards the upside, and I think it is only a matter of time before the buyers break above the most recent high. With that being the case, I think that eventually, we will go looking towards the $1850 level, and then after that the $2000 level. Clearly, we will not get there overnight, but I think that is where we will go given enough time.

If we break down below the lows of the Friday session, we could go looking towards the 50 day EMA near the $1760 level. This of course is a major technical indicator and one that the market has been following for some time. I think that is your “moving floor” in the market and I think that it is only a matter of time before buyers would jump in and try to pick up gold in that general vicinity. I think at this point it is highly likely that we will see plenty of volume down in that area that would turn things around. Beyond that, the $1750 level has been massively resistant so it makes sense that it would be a massive support.

Central banks around the world continue to loosen monetary policy so it makes quite a bit of sense that we would see gold rise over the longer term, which is a typical market reaction. In fact, what is even more pressing is the fact that the US dollar is under serious pressure, and that would also give gold a bit of a boost as well. I believe that the gold markets are probably going to be the main story for the next year or so and that every time we dip it is probably going to offer plenty of value the people are willing to jump all over. In fact, at this point, I have no scenario in which I am looking to start shorting this market, and therefore it would take some type of monumental change in central bank policy and the global economic conditions to start thinking about gold in a negative light at this point.