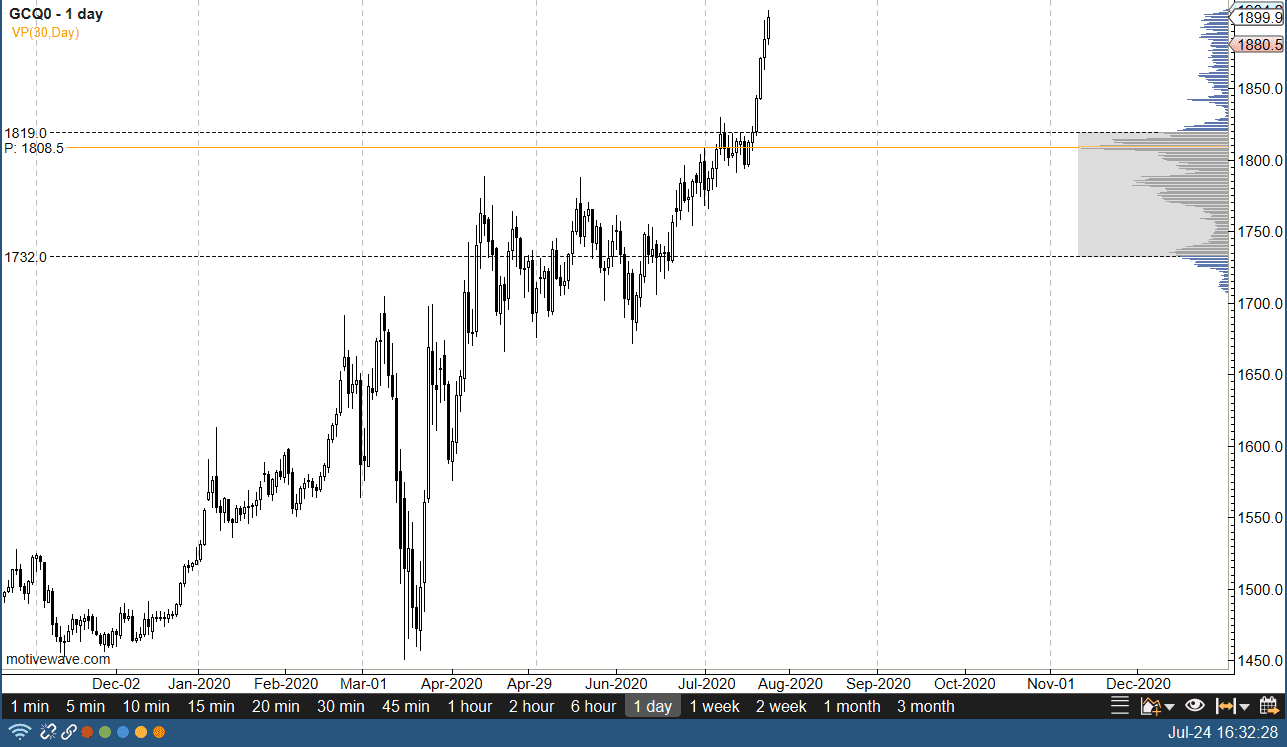

Gold markets have been explosive to the upside over the last several weeks, and now it looks as if the traders out there are going to have to find some type of catalyst to continue the move one way or the other. Ultimately, I think that the $1900 level will cause a bit of resistance, but as we go into the month of August it is probably only a matter of time before we get buyers. The $1800 level has previously been resistance, and it now essentially will be the “floor” in the market.

With the Federal Reserve out there looking to dump US dollars into the marketplace it makes quite a bit of sense that the gold market will continue to attract a lot of attention. It is worth noting that the last couple of weeks that we have shot straight up in the air, and that being the case I like the idea of waiting for some type of value to enter the market. It is only a matter of time before we see the market pullback, perhaps reaching down towards the $1850 level, perhaps even down to the $1800 level. I do not know if we can get all the way down to the $1800 level but that would obviously be the most ideal entry.

Longer-term, my target is $2000, and we could get there by the end of the month, especially if the US dollar continues to get hammered. For what it is worth, you should be paying attention to the US Dollar Index, because it will be crucial as far as an indicator is concerned as to where this market goes. Another proxy for that would be the EUR/USD currency pair, as it is so heavily weighted in that US Dollar Index. Both the Euro and the Gold markets look parabolic at this point, so simply being patient enough to wait for some type of value is probably the best way to go. Regardless, there is absolutely no way to short this market and we have much further to go to the upside. With that in mind, I am very bullish of gold and will continue to be so for months. It would take a drastic change of attitude coming out of the Federal Reserve and the global economy for the gold markets to suddenly turn around. Buying dips in bits and pieces to build up a larger position should continue to be the way forward.