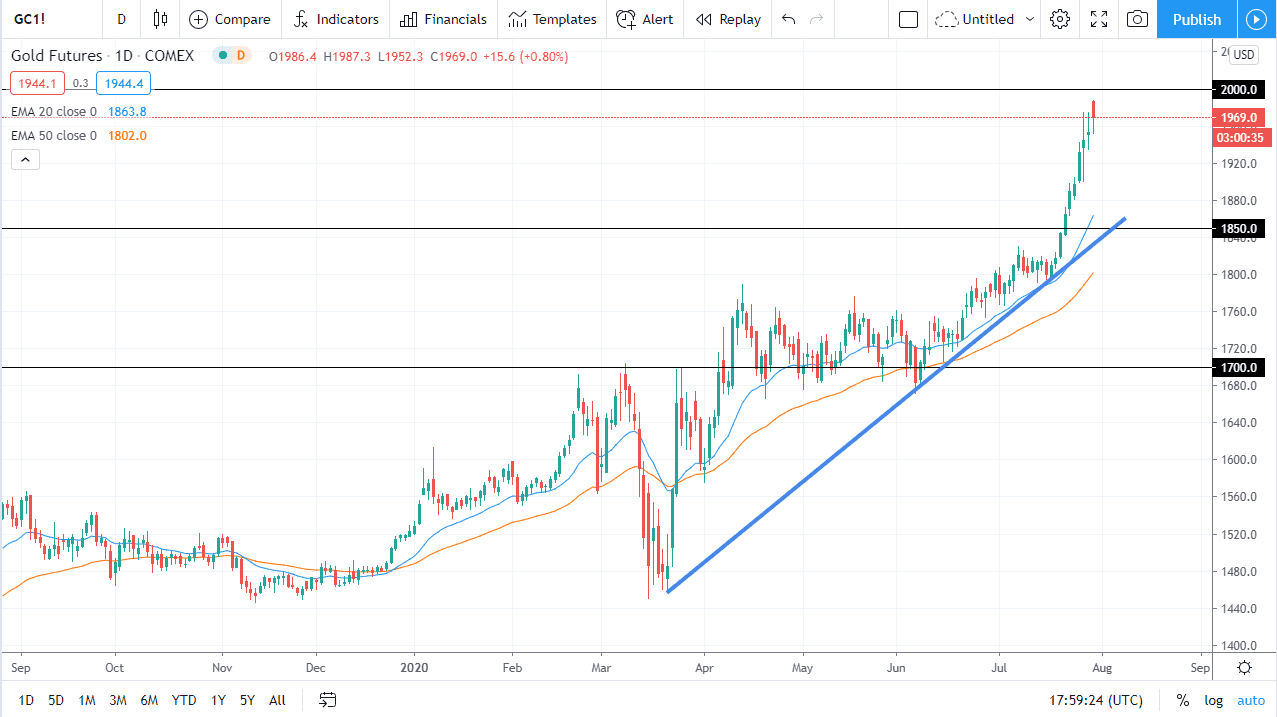

Gold markets have shown strength, rallying right off the bat in order to show strength again, but then fell to fill the gap before finding buyers. With that in mind, it looks like the gold markets are ready to continue the rally overall but are obviously a bit stretched at this point. Because of this I am not willing to short this market, and I think that every pullback is probably going to be thought of as a potential buying opportunity. That being said, the market is a little bit extended so I would like to see more of a pullback before I get overly interested.

I know that the market is hard to watch, as it rips higher if you are not involved, but these types of moves always have some type of significant pullback, and the last thing you want to do is start buying right before that happens. After all, if the market suddenly drops $50, that could be deadly to the futures account. With that being the case, I like the idea of buying dips, but I will base that on the daily candlestick more than anything else. After all, the volatility in the market will continue to only pick up, and then of course you have to worry about the $2000 level above which will almost certainly cause a certain amount of selling pressure as well. It would not surprise me at all to see a thrust towards that area only to see the market roll over and start selling off.

This is all about the US dollar and how it is behaving, so pay attention to the US Dollar Index. If the US dollar index continues to weaken, then it should continue to drive gold higher and of course vice versa. Ultimately, this is a market that is tracking the Federal Reserve and its plans. Nonetheless, even though we all know that the monetary policy is going to continue to see a lot of stimulus, so that of course will push this market higher. If and when we can get some type of close above the $2000 level, it is likely that we could continue to go higher but I really hope that we at the very least kill some time before breaking out. A pullback of course is preferable, because like anything else you want to be able to buy it when it is “on sale.”