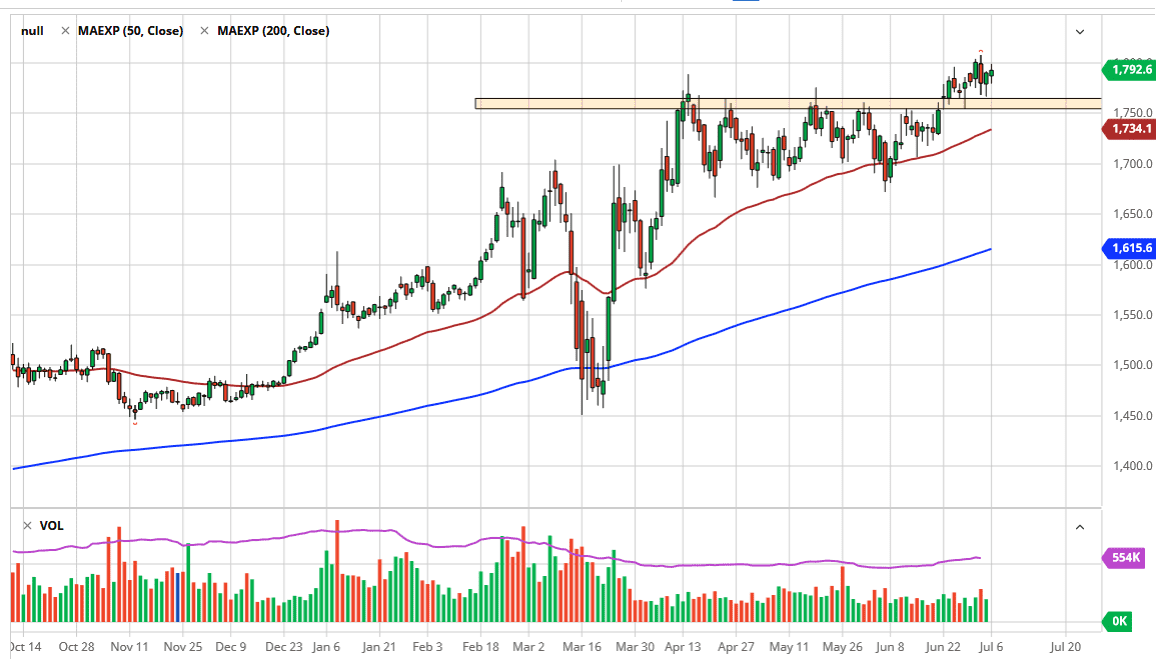

Gold markets have rallied again after initially falling on Monday. This does not surprise me that much, as gold has been in a relentless uptrend for months. In fact, the only time that we had a significant pullback was due to traders trying to get profits taken out of the market in order to cover massive losses in other parts of their portfolios. This was back in March, and since then gold has sent had very much of a pullback. There has been consolidation, but not a huge pullback.

The $1800 level above continues to be massive resistance, and the fact that we managed to pierce that level last week suggests that we are eventually going to make it above there. Once we do, the market is likely to go looking towards the $2000 level which of course is a large, round, psychologically significant figure. At that area, I would anticipate seeing a lot of selling pressure, but once we get above there it is likely that the market just rips to the upside. I think that happens given enough time but there is a lot of work to do before that even becomes a question.

To the downside, I see the $1750 level as support, just as I see the 50 day EMA offering support. After that, then we have a major support barrier at the $1700 level. In other words, there is far too much support underneath to even think about shorting this market. Beyond that, there are plenty of fundamental reasons to think that gold will attract a certain amount of attention, because central banks around the world are throwing money at the markets. That in general should continue to put a bit of a demand for gold in general. Furthermore, we have a lot of concerns around the world that could cause markets to pile money into gold. The most obvious one is the coronavirus figures that continue to go higher, and that could shut down global growth. If it does, then people will look for safety and gold. Furthermore, the US/China trade situation as well as overall geopolitical tensions continue to get worse. The pullbacks at this point in time should continue to offer plenty of buying opportunities, and as a result, I will be looking at dips as an opportunity to add to a position that I already have established in gold. Eventually, we will get the pop higher and we should reap benefits.