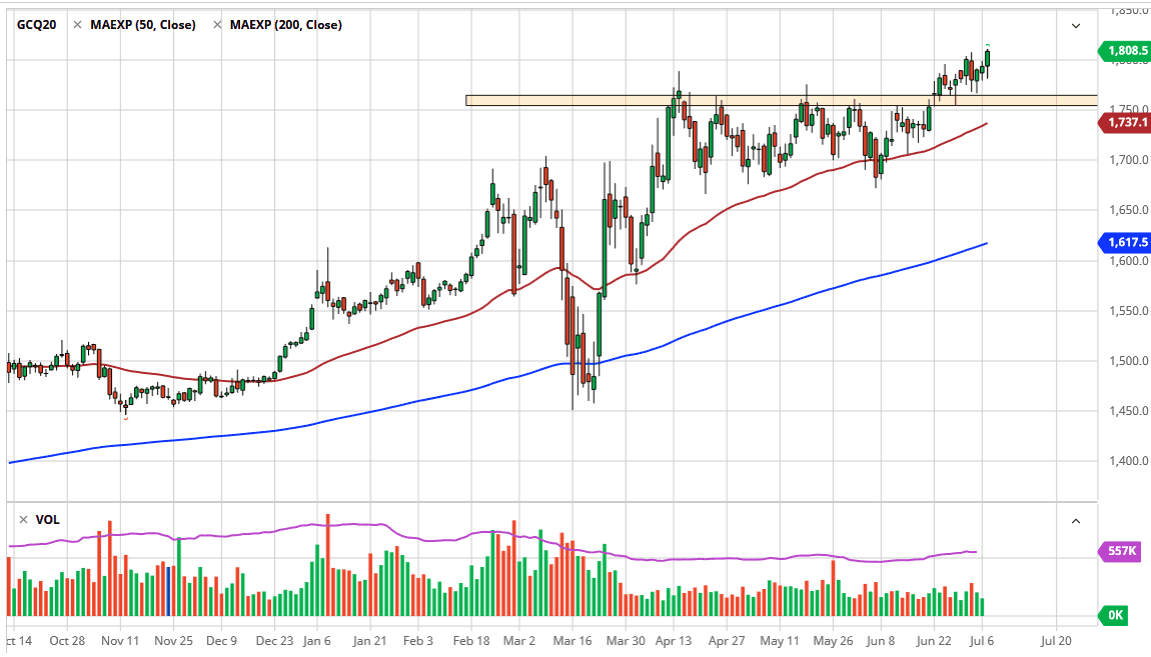

Gold markets have rallied during the trading session on Tuesday again, breaking out to a fresh, new high. Now that we are closing above the $1800 level, we are opening up the possibility of a move much higher. This was accompanied by the US dollar’s weakness and a bit of profit-taking in the stock market. That being said, I believe that the market is likely to see a lot of interest, as we have broken above that large, round, psychologically significant figure.

The very first thing that you should notice on the chart is that we have been in an uptrend for some time, so that is probably the most important piece of information. After all, the last thing you want to do is fight the overall trend, so, therefore, looking at this chart it is obvious that you should not be selling regardless of what happens. In fact, I do not even have a scenario where I am looking at this market in a bearish light until we break down below the $1700 level at the very minimum.

Ultimately, I think that what we are looking at is a market that you can buy dips in, as we continue to see value hunters out there taking advantage of the central banks around the world offering massive amounts of liquidity. Gold will continue to rise as people look at the devaluation of currencies, and with the Federal Reserve throwing money out the way it is, the fact that this market is priced in US dollars also helps as the US dollar has been crushed as of late. Furthermore, we have a lot of concerns when it comes to the coronavirus and what it is doing to the global market and global trade. Central banks are in “full easing mode” and in order to take some of the issues out of the economy, this bodes very well for so-called “hard assets” such as gold. With this, I believe that pullbacks offer value that you can take advantage of, starting at the $1800 level. After that, the market will look to the $1750 level as support and the 50 day EMA after that. In other words, there are plenty of areas that we should see buyers interested in this market, so, therefore, I think it is only a matter of time before we take out the highs of the day during the trading session on Tuesday. I believe that we are going to go looking towards the $2000 level longer-term.