Gold markets have had a strong session on Monday, breaking towards the $1945 level before pulling back just a bit. The market is clearly bullish and even though we have pulled back a bit it is almost impossible to short this market. The US dollar has been hammered against almost everything, so it would make quite a bit of sense that we would continue to see gold rally over the longer term. With that being the case, the market is likely to find value hunters on any type of pullback we get.

With that being said, you certainly need to pay attention to the US dollar in general, and if it continues to struggle, we will more than likely see the gold markets continue to go much higher. The $2000 level above is the target, but it may take a little bit of time to get there. With that in mind, I am a buyer of dips as I recognize there are plenty of support levels underneath that will eventually be tested, and even if we went higher tomorrow, I would be a bit cautious about going long. Eventually, gravity comes back into play and we get a bit of an opportunity to buy gold at a lower level.

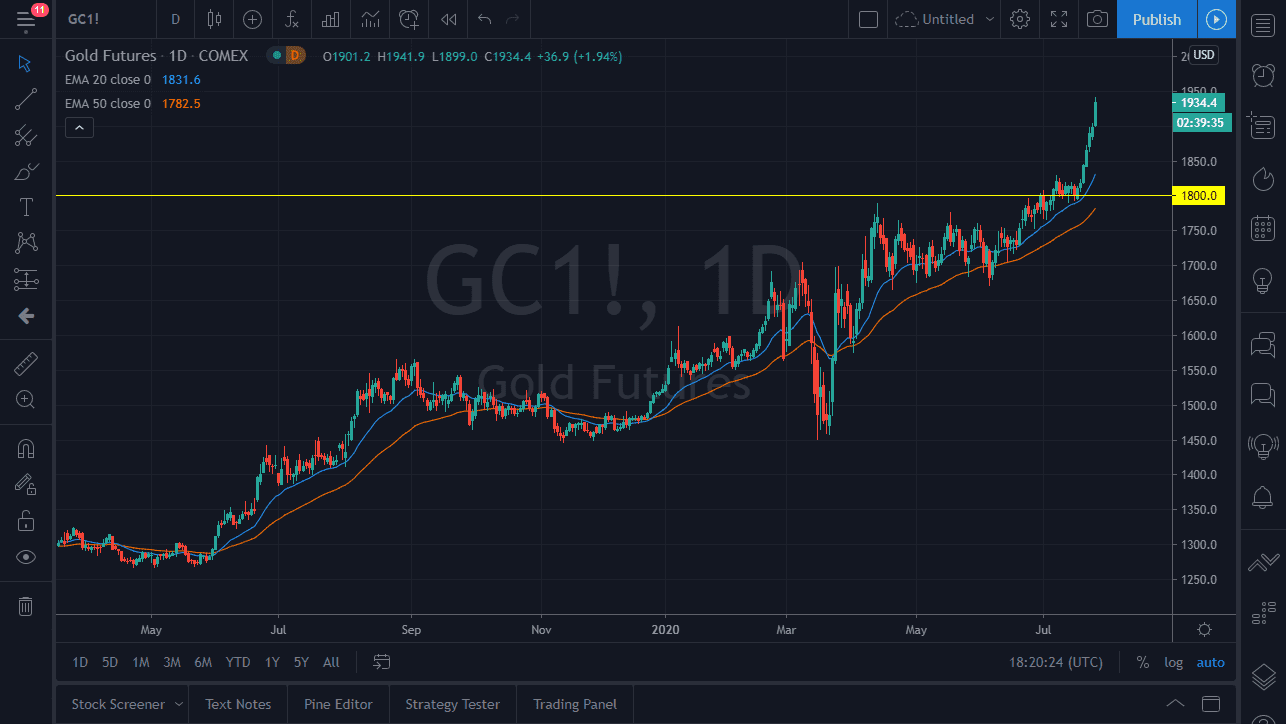

I believe the $1800 level is essentially the “floor” in the market right now, so it will be difficult to see the market break down below there. The 20 day EMA is breaking above there and the 50 day EMA is also showing its proclivity to break above the $1800 level so I think it is only a matter of time before we get some type of support based upon that as well. If we were to break down below the 50 day EMA, that could send this market much lower and it certainly would be a “shot across the bow” of gold traders. Right now, the fundamental analysis does not favor anything like that, so the only potential trouble that I could see for the gold market is not only a pullback due to the overextension, but it is possible that we may see something like we did several months back when traders had to sell gold in order to cover major losses in other markets. That right now is about the only real danger that has any significance. Even that could be turned around and make this market go higher. I remain very bullish.