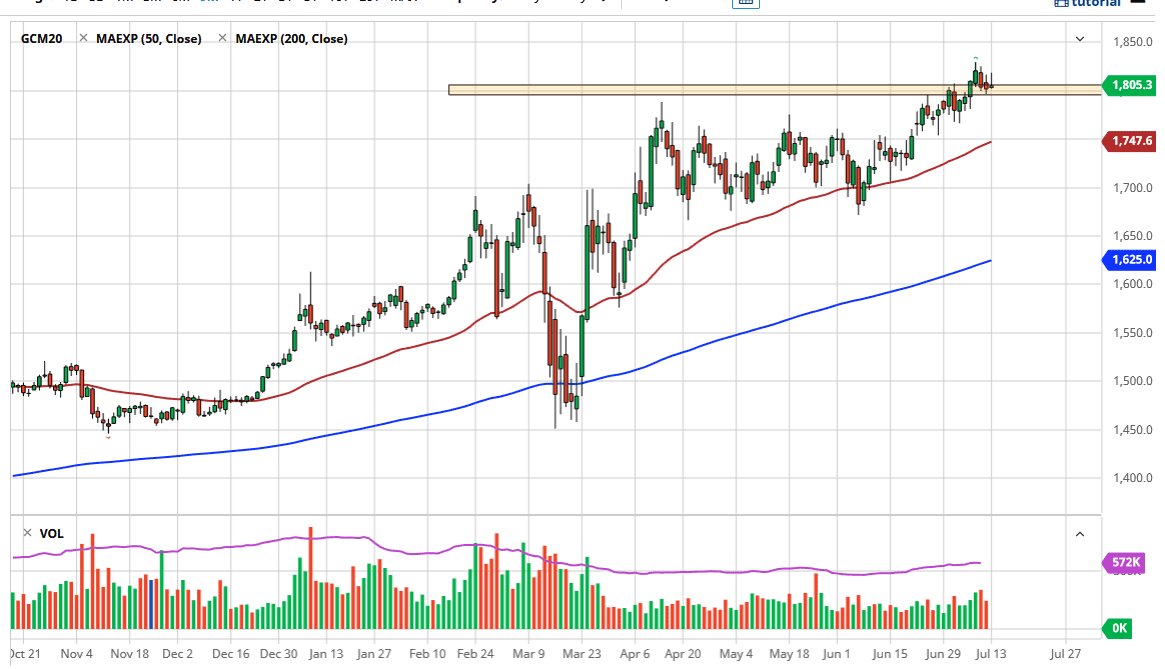

The gold market initially tried to rally during the trading session on Monday but found quite a bit of resistance above as we sold off late in the day. California is starting to shut down a lot of things again, which suggests that perhaps the United States may go back as far as the coronavirus is concerned. That said people are running towards the US Treasury market, which demands US dollars. Furthermore, people will have to sell winners sometimes to take care of losers in the stock market, something that gold has suffered at the hands of more than once.

We are currently sitting right around the $1800 level, which is an area that will attract a lot of attention as it was previous resistance. That being said, I think that the market will probably dip below the $1800 level in the short term, to find support underneath. Alternatively, if we can turn around a break above the top of the candlestick for the day that would be a very bullish sign. I think that we will go higher over the longer term, as central banks around the world continue with monetary policy easing, and therefore are all essentially doing a bit of “quantitative easing.” The biggest problem is that all central banks are doing it, so gold is probably the purest play away from fiat currency right now.

Looking at the chart, I think that the market is likely to see a lot of support at the $1750 level, as it is the scene of the 50 day EMA. That is a technical indicator that a lot of people are paying attention to so I would not be surprised to see the gold market pullback towards that level again. Whether or not we make it all the way down there might be a different situation or question altogether, but I do think that eventually, the value hunters come back out. The fundamentals are still extraordinarily strong for gold, despite what we saw during the trading session on Monday. It may take a little bit of momentum building, but I do think it is only a matter of time before we reach towards the upside. I still think that gold will go looking towards $2000 eventually.