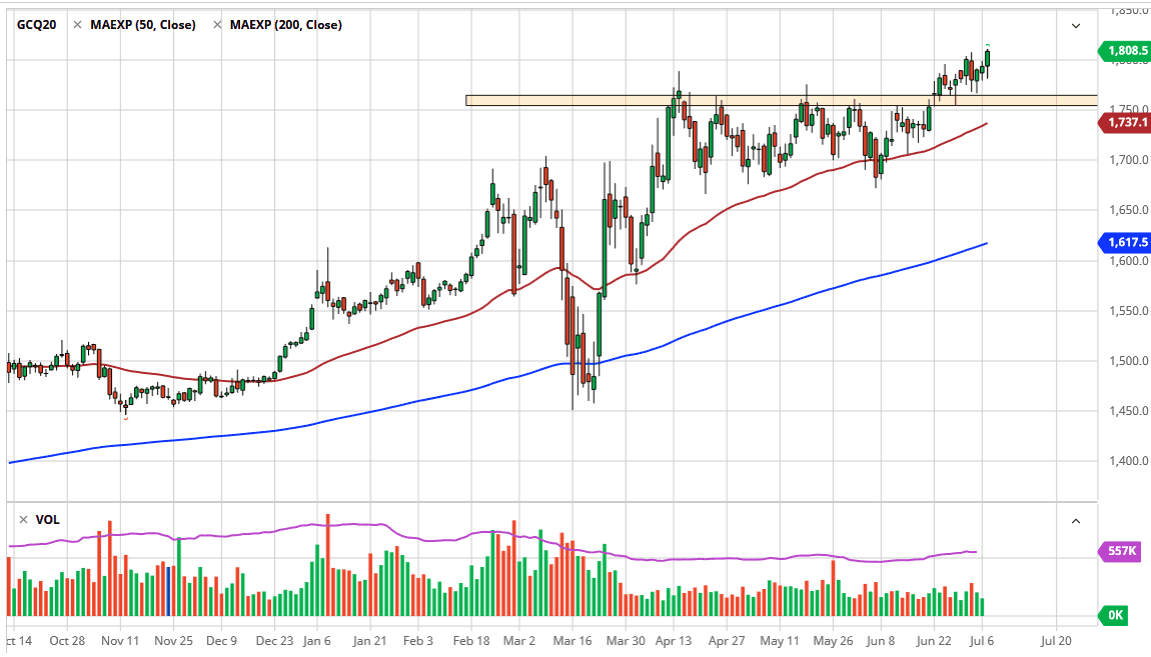

The gold markets have rallied significantly during the trading session on Wednesday, slicing through the $1800 level. At this point, the market then reached towards the $1825 level, but then pulled back a bit to see a little bit of profit-taking. Nonetheless, the market is likely to see plenty of buyers on dips, with the $1800 level offering a bit of support due to the fact that the level had been such significant resistance.

Now that we have clearly broken above the $1800 level, it is likely that the level will continue to be important, as we have reached into the next potential trading range, which I think allows the gold market to go looking towards the $2000 level over the longer term. I will buy dips at this point especially as central banks continue to flood the market with liquidity. This will wear upon the value of fiat currencies overall, and it should be noted that gold markets have already broken out long before this against other currencies such as the Euro and the British pound. At this point, the market is likely to see quite a bit of momentum and a bit of “catching up” out there against the greenback.

Pullbacks at this point in time will not only see significant support at the $1800 level, it is likely that we also see it near the $1750 level, which also coincides quite nicely with the 50 day EMA and the same general vicinity. We are in an uptrend and have been for some time, so it is obvious that the trend is still very bullish, and we should not be arguing about which direction to trade this market. I do not even have a scenario where I am selling gold anytime soon, because there are far too many reasons to think that it could go higher. After all, beyond the fact that the central banks have been liquefying the markets, the world has a whole host of potential problems out there that could cause issues with fear, and that could have the trading community looking for gold as a safety measure. While I believe we will get to the $2000 level eventually, it is going to take some time to get there. Because of this, keep your position size small and only add as it works out in your favor. Although this is a relatively straightforward trade, you seem too much leverage could be extremely dangerous in this type of environment.