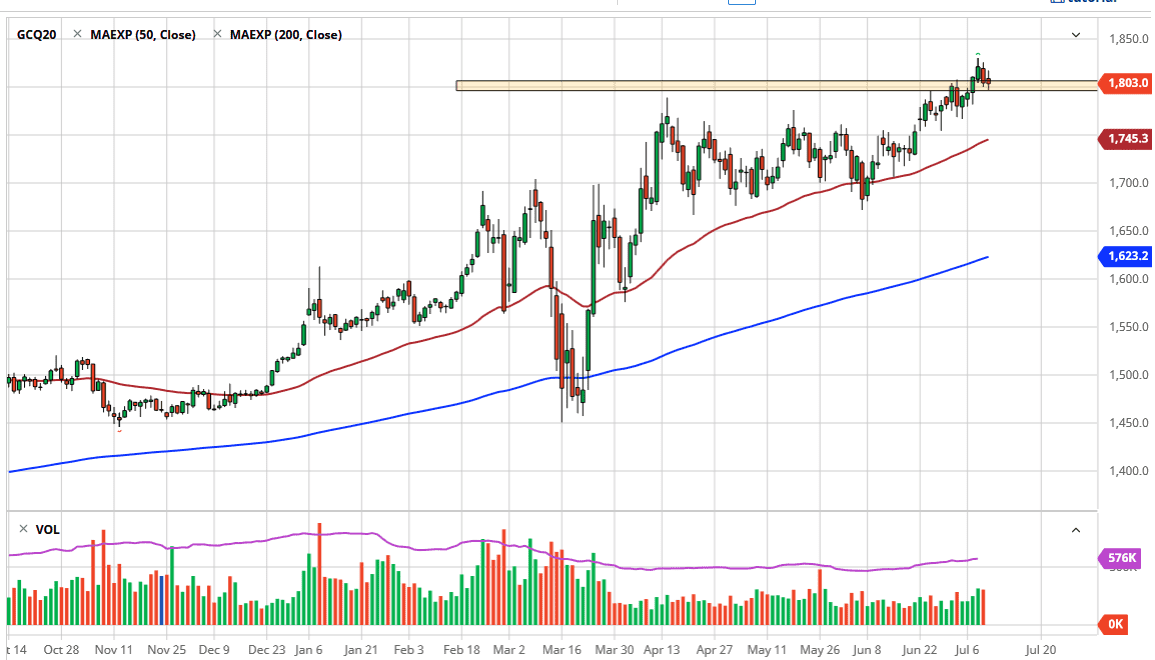

Gold markets have initially tried to rally during the trading session on Friday but then pulled back a bit to show signs of exhaustion. This exhaustion makes quite a bit of sense, as we started to reach towards the weekend, the $1800 level will be casting a long shadow above the market. If we break down below the bottom of the $1800 level, then I think there are a multitude of support levels underneath that could come into play.

The $1800 level is the first place that I expect to see buyers, but even underneath I would anticipate that the $1875 level could come into play, and most certainly the $1750 level. The 50 day EMA is starting to come close to that level, and I think that $1750 will be difficult to break down through. In that area, the market is likely to bounce and continue to find the 50 day EMA as longer-term support. A bounce from there would be attractive as it would offer gold on the cheap, something that a lot of people will be looking for. The market is more likely than not to continue going much higher, reaching towards the $2000 level over the long term as the loose monetary policy will continue to be a major issue.

The candlestick for the Friday session is a bit of a shooting star so it does suggest that perhaps we have a little further to go to the downside, and therefore I think it is only a matter of time before we form a supportive candle that we can take advantage of. If we get some type of hammer or a candlestick like that on the daily chart, then I think it is only a matter of time before the value hunters take over again. The gold market is one of the hottest markets right now, so it does make sense that we would see a little bit of recovery. At this point, the longer-term uptrend line should continue to send gold to higher levels, with the next major target being the $1850 level, but I do think that by the end of the year we could see a move towards the $2000 level. In this scenario, I have no interest whatsoever in trying to short the gold market, it has been far too strong over the last several months.