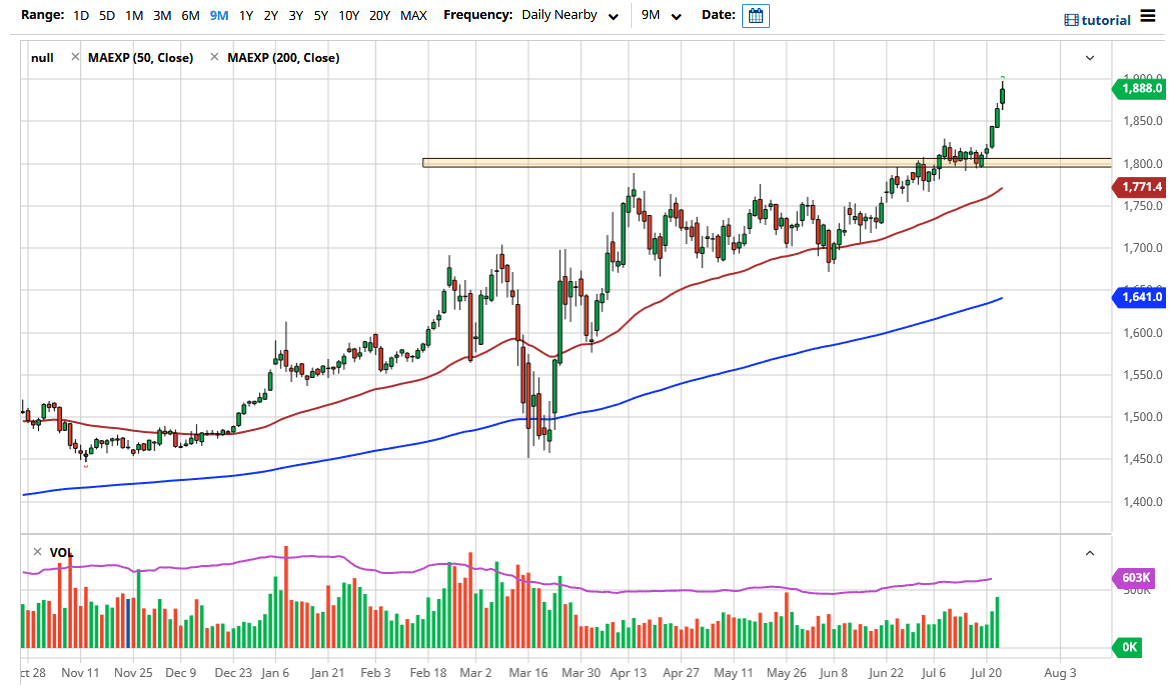

The gold markets have rallied significantly during the trading session on Thursday again, reaching towards in $1900 level. However, the market is likely to see a bit of a pullback as we have gotten a bit stretched, and of course as we head into the weekend it would not be a huge surprise to see people take profits. After all, just about anything can happen over the weekend so a little bit of volatility would not be a huge surprise on Monday. To the downside, I think that the $1800 level is massive in its implication, as it had been significant resistance.

Ultimately, this is a market that I think will continue to gain due to the fact that the Federal Reserve is working so hard against the value of the US dollar, via quantitative easing. The dollar is historically expensive against many other currencies, so I think that this goes on for quite some time, especially as the US Dollar Index has broken down through support during the day. That should continue to boost gold, but quite frankly I think there is an argument to be made for the short-term pullback that offers a bit of value that you should be looking at. Furthermore, the traders that had been short of the gold market at the $1800 region will desperately want to get out of the market close to the breakeven point, and that would more than likely cost support as well. For those out there that missed this move, they would love to see this pullback so they can get involved as well. Clearly, we have broken out and look likely to go higher.

To the upside I believe that we will eventually make our way to the $2000 level, which has been my target for some time. If we can break above that level, it gets even more bullish but, in the meantime, I think that we get the pullback, the retest, and then eventually grind our way to words that $2000 level sometime in Q3 or possibly even in Q4. After all, look at how we had bounced around underneath the $1800 level before finally taking off, so it would not be a huge surprise to see that happen again. I do anticipate that the US dollar has further to go to the downside, but it is not going to be a straight line by any stretch of the imagination.