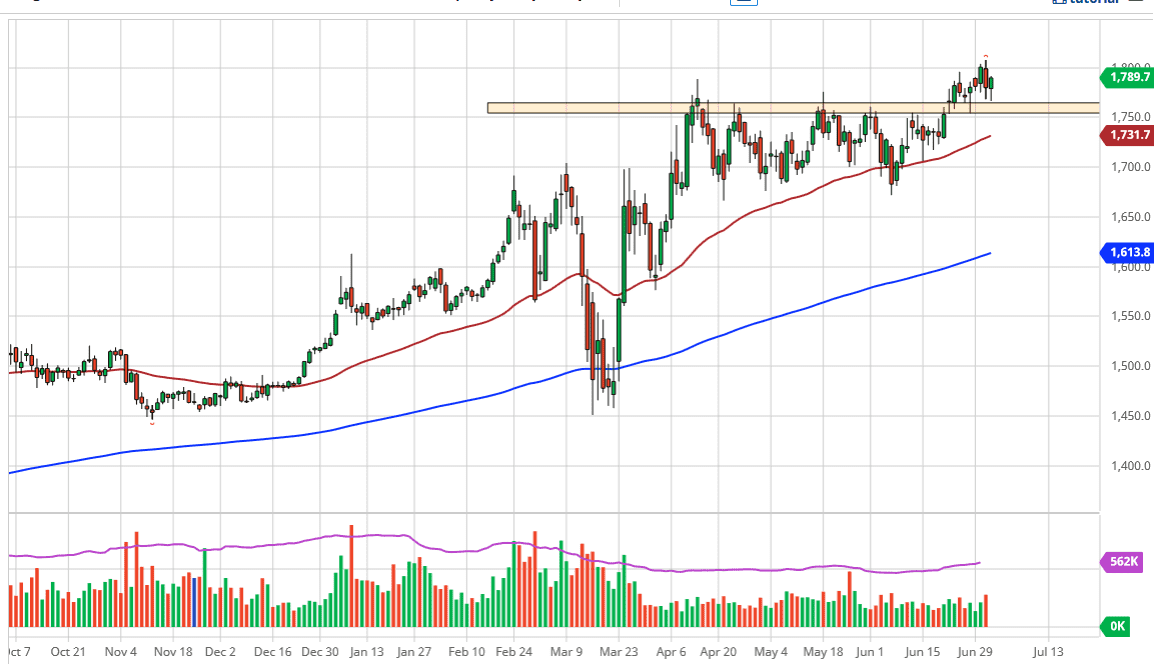

The gold markets initially fell during the Globex session on Thursday but found a solid wall of support at the $1765 level. By showing that support, they then started buying this market and pushed it high enough to form a bit of a hammer. This hammer of course is a very bullish sign and suggest that we will continue to see buyers in this market and a continuation of the uptrend. That being the case, I think we are aiming for $1800 given enough time, and eventually I do expect that we will break out and go much higher. Once we get above the $1800 level, I think that the next major target is going to be $2000.

To the downside I see several different areas that could offer massive support, not just the $1765 level. I believe that the $1750 level will be supportive, and the 50 day EMA which is currently down at the $1731 level will be. Beyond there, then we are looking at the $1700 level offering quite a bit of support as well. There should be plenty of buyers on these pullbacks, and therefore I look at this as a market that will probably need to be thought of as offering value when it drops. After all, there are plenty of fundamental reasons to continue driving the gold markets higher, and those simply are not going away.

There is a lot of concern when it comes to the coronavirus, and the slowing down of the global economy. The knock on effect is that central banks will continue to print money as fast as they can, and that generally will lift the precious metals markets as traders look for “hard assets.” If and when we get some type of massive inflation, it is likely the gold will skyrocket at that point. That I believe is what traders are setting up for, as investors pile into gold and record amounts lately. At this point, I do not even have a scenario where I am willing to short gold, because I just do not see that coming down the road right now. With all of this, I believe that buying on the dips is the same thing is picking up “gold on the cheap.” Looking forward, with the added stimulus and fiscal spending, as well as the potential of negative headlines coming out of US/China tensions, and a whole host of other things I have not even mentioned, gold should continue to do quite well.