The gold markets rallied during the trading session again on Friday as we continue to see a lot of bullish pressure. However, at this point, if you are not already long of this market, you are best to wait for some type of pullback. One of the greatest ways I know to lose money in the market is to “chase the trade”, and if you are just now getting into the gold market, you are most certainly doing that.

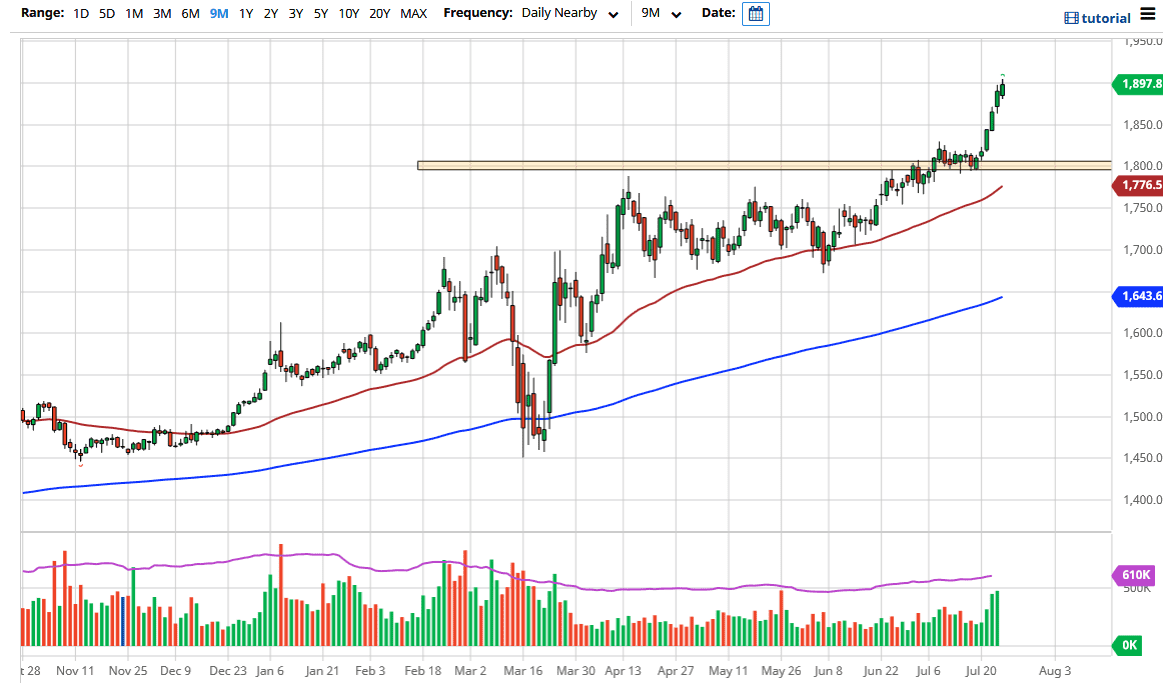

Take a look at the chart and notice that every time we rally impulsively like this you have plenty of time to get involved. It is a matter of being patient enough to take advantage of what a significant break is out and a significant shift in the attitude of the markets. I think at this point it is likely that we will find plenty of support near the $1850 level, and most certainly at the $1800 level which is a massive level of support which had previously been significantly resistant. Furthermore, the 50 day EMA is sitting just below the $1800 level, so that would also offer quite a bit of support.

Looking at this chart, you can see that the last five days have been strong, and therefore we need to take some type of breather in order to keep of this type of momentum. This is all about the US dollar getting hit and therefore it makes sense that gold would rally as people start to worry about the purchasing power of their own fiat currencies getting destroyed, as it is not only the Federal Reserve that is flooding the markets with liquidity but it is also the ECB, the Bank of England, the Bank of Japan, etc.

At this point in time, I like the idea of buying dips, but I would like to see this market drop at least $50 to get involved. I do believe that we are eventually going towards the $2000 level, which is my long-term target. I thought previously that we had been looking at a $2000 price by the end of the year, but we could see that much sooner based upon the volatility in the strength that the gold market has suddenly shown. In fact, we are seeing this across the precious metal sector, not just gold itself.