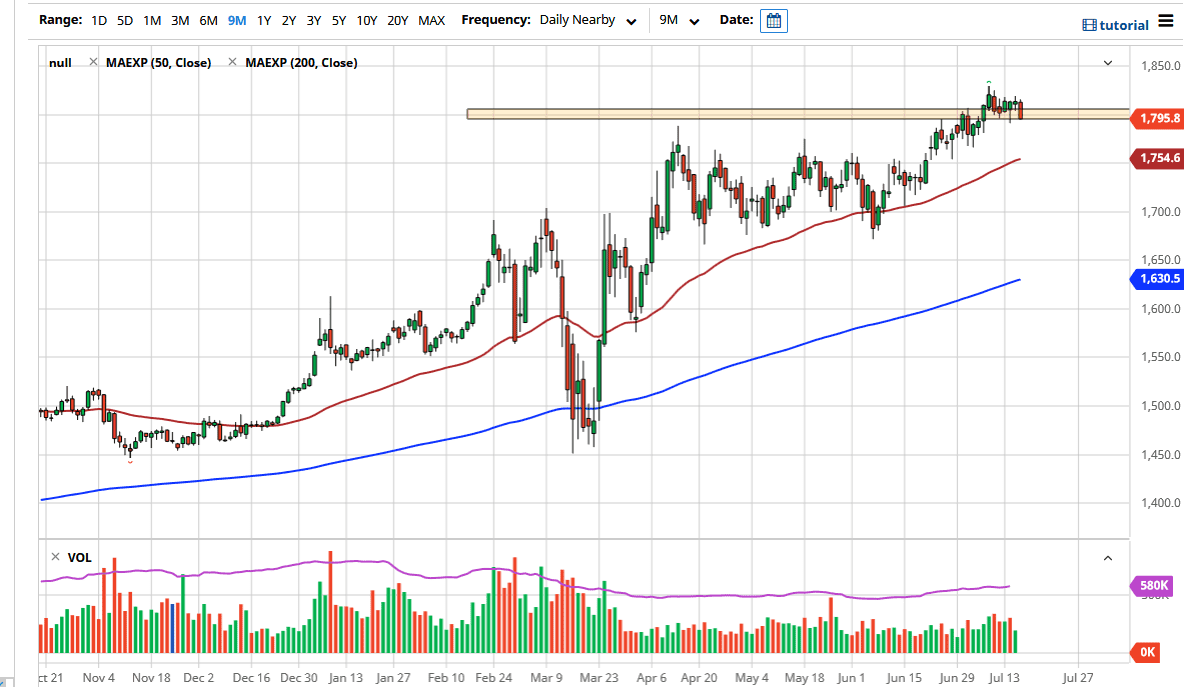

Gold markets fell hard during the trading session on Thursday, as we started to see a little bit of US dollar strength. That being said, the dollar has only limited life based upon everything that is going on around the world and more specifically in the United States with the coronavirus figures. Because of this, it is likely the gold is going to offer a lot of value on this dip. I think it is only a matter of time before we see buyers come back in, especially near the bottom of the candlestick for the Tuesday session.

Underneath there I see the 50 day EMA as a strong potential candidate for buying pressure, as it could send this market right back towards the $1800 level again. The 50 day EMA does tend to attract a lot of attention so this would make quite a bit of sense. Ultimately, I believe that this is a market that will probably continue to see buyers based upon value, as central banks around the world continue to loosen monetary policy. The most important one right now as the Federal Reserve, and they most certainly are not anywhere near thinking about cutting back on quantitative easing. This does mean that gold will do well over the longer term, but occasionally you may get a hiccup like you had during the Thursday session.

This is a market that is rather easy to trade in the sense that it is not a matter of whether or not you should pick a direction, just whether or not you should be buying at the current level. This is most decidedly a “one-way market”, so I look at these dips as an opportunity, not something that I need to overthink. Given enough time underneath, there will certainly be some type of bounce or support of candle that I can jump all over. If I get that then I am more than willing to actively buy the contract, aiming towards the $1850 level, and then the $2000 level from a longer-term standpoint. Having said that, it does not mean that we will get there overnight nor does it mean that it will be easy. What it does mean however is that the trend leads that direction and the fundamental certainly work out in that direction as well. Gold is probably going to be the biggest trade of the year still.