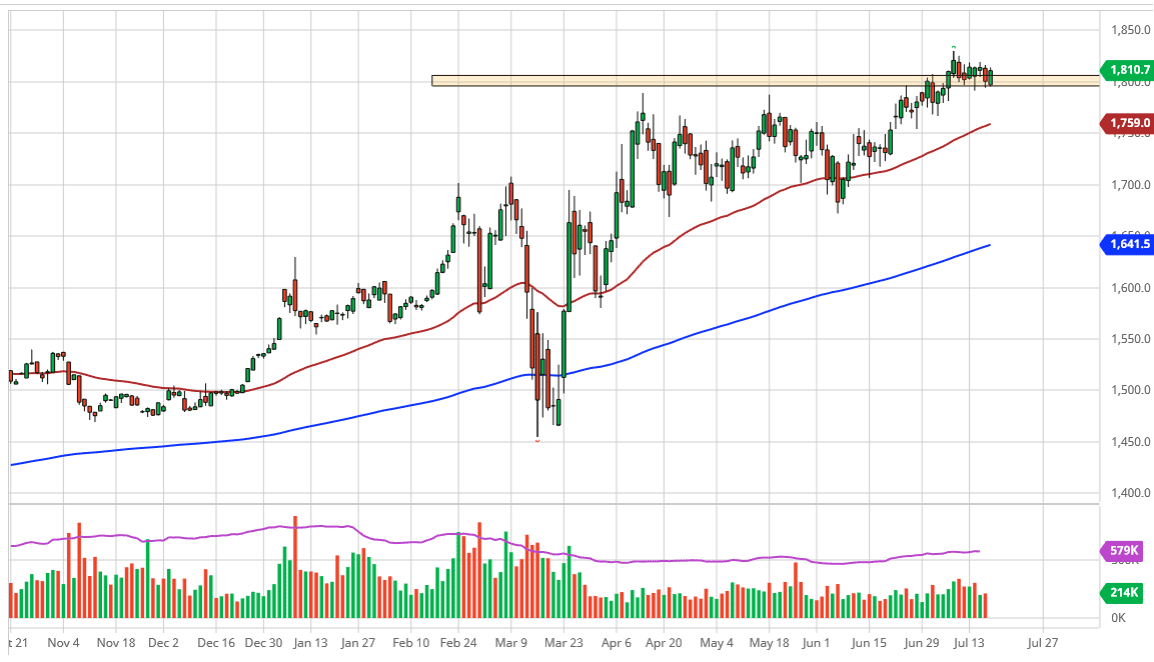

The gold markets turned around to show signs of life again, as the Friday session ended the week with positivity. The market continues to see buyers underneath the $1800 level, so I think it is only a matter of time before we build up enough of a base to break out to a much bigger move. I think the idea of buying dips continues to be the best way going forward, as the short term volatility continues to make this more of a back-and-forth scenario.

Looking at the overall structure of the market, it is obvious that we have had strong signals all the way up, and I think that the $1759 level, where the 50 day EMA is sitting, is likely to see a certain amount of buying pressure. The 50 day EMA has been relatively reliable for several months, and at this point I would assume that there should be people buying it. Beyond all of that, there is a huge push by central banks out there to continue to do quantitative easing, and therefore it has people looking at the gold markets for safety to protect wealth. Over the longer term, I believe that gold will continue to show itself to be a viable trade, and as a result, I like the idea of buying it every time it pulls back.

In fact, I believe that there is a perfect set up right now for a longer multi-month run, if not multi-year. That does not mean that we will not have the occasional pullback, but I do recognize that the market continues to find plenty of reasons to get involved to the upside so as long as monetary policy remains this way, it is a one-way trade. Beyond that, there is a lot of fear out there and gold is used for safety as well. The eventual target that I have in mind is $2000, but it is going to take some time to get there. I believe that by the end of the year we could see that level, but in the meantime, you simply take a look at any short-term pullback as an opportunity to pick up gold “on the cheap”, which has been the way going forward for the last several months. Granted, we have been somewhat sideways, but when you look at intraday charts that is what you see.