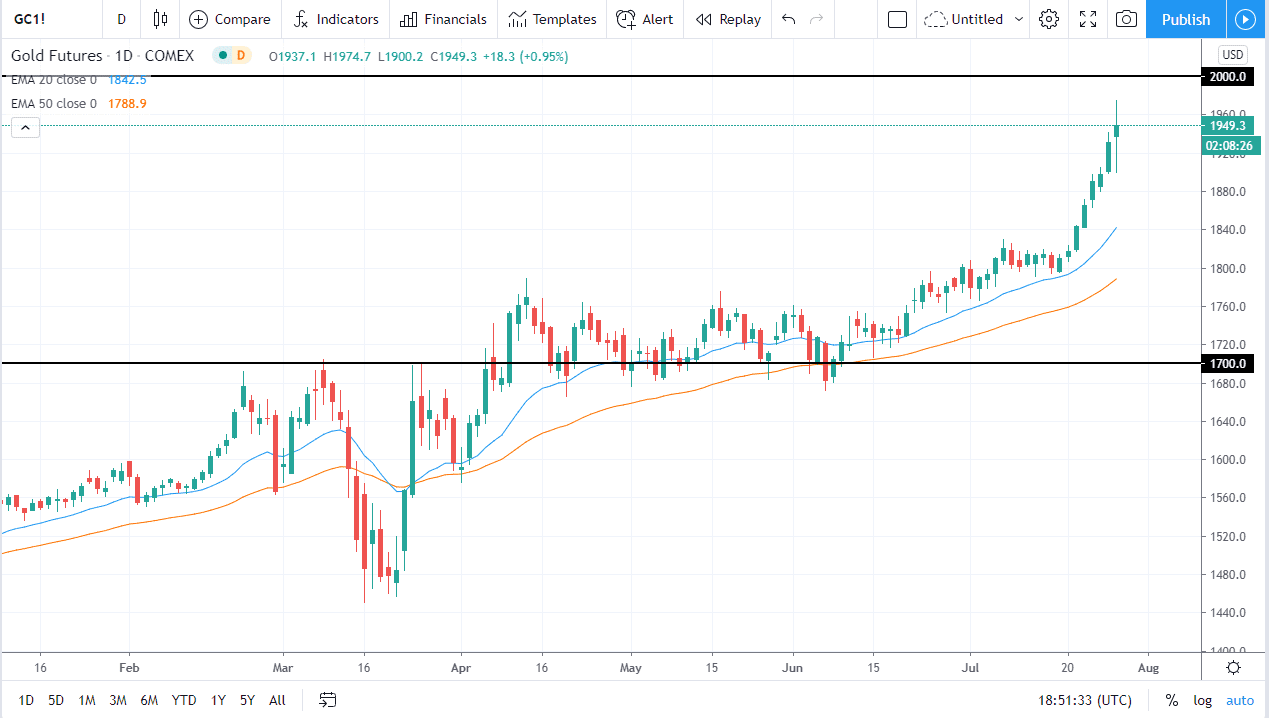

The gold markets have gone back and forth during the course of the day on Tuesday, initially breaking above the $1960 level in the front month of the futures contract, and even touched the $2000 level in the spot market. We had the market roll over and explode in a very quick amount of time during the Asian session, only to recover again. As we close out business in New York, it looks like we are going to stop somewhere around the $1950 level.

The candlestick for the trading session is a “long-legged doji”, something that typically signifies that you are getting close to the end of a move higher. This does not mean that the trend has to end, but we are more than likely going to see a pullback. Quite frankly, that pullback would be welcomed by many of the trading community out there that have missed the move. They should offer a nice buying opportunity, in my first area of interest would be closer to the $1840 level. Yes, I recognize that it is $110 lower, but it is also where we have the 20 day EMA.

The US dollar continues to get crushed against other currencies around the world, so that will continue to push the gold market higher in general. That does not mean that we need to go straight up in the air and quite frankly we have gotten overdone. We need to see the market pullback in order to offer a bit of value the people can take advantage of. The $1800 level would more than likely offer a massive support level, and I would be a bit surprised to see that level broken. If it was, then I see even more support at the $1700 level.

A parabolic market is one that pulls back, but it also tells you where we are going longer term. Longer-term, we are going towards the $2000 level, and I would anticipate that level in the futures market to offer a massive amount of resistance. We have simply come too far in too short of amount of time to slice right through it. However, we will spend the next several weeks if not months building up the necessary momentum to not only break through there but continue to go much higher.