Gold was quiet during the Friday session as traders were away for the Independence Day holiday in the United States and therefore was essentially a Globex session only. In fact, Chicago closed down midday, and therefore you cannot read too much into the Friday session itself. However, the Thursday candlestick pulled back towards the lows from the Wednesday session and then bounced to form a bit of a hammer. The hammer of course is a very bullish candlestick as it shows that previous resistance is now offering support, and it is likely the gold will make a significant move to try to break above the $1800 level.

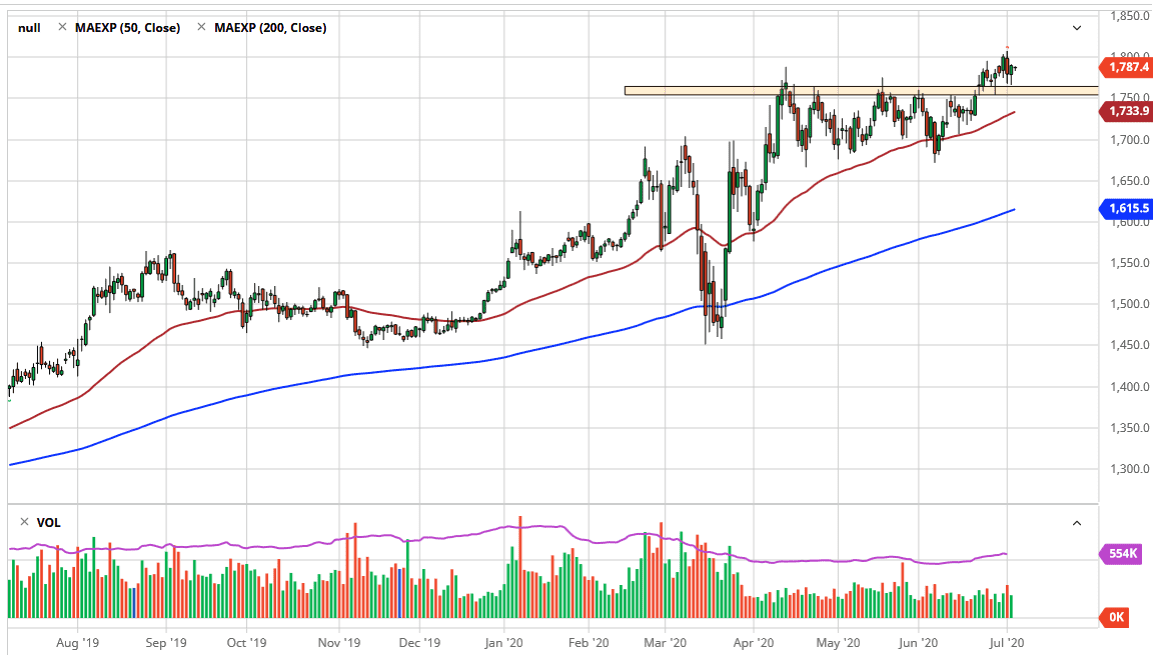

During the trading session on Tuesday, the market actually did pierce the $1800 level but was repulsed by massive selling. This was the first “shot across the bow” of that level by the bullish traders, and therefore I think we have perhaps taken out some of the stops up in that area. Eventually, we should see this market break above there and go looking towards the $2000 level. Underneath current trading, I see the $1765 level as support, the $1750 level as support, and of course the 50 day EMA is currently sitting at the $1733.90 level as support. After that, then $1700 will be extraordinarily supportive as it has been in the past. In other words, I see a handful of buying opportunities underneath, and do not show any idea of buying gold “on the cheap.” However, we may not get that possibility if we get some type of negativity or headline that spooks the market into running for safety. If that is the case, that will be what sends gold parabolic.

I think buying on the pullbacks continues to be the best way to play the gold market, looking for value every time it is offered. It is hard to make an argument for shorting gold anytime soon because there are so many negatives out there when it comes to economic headwinds and of course central banks around the world continue to flood the markets with money, which drives down the value of fiat currencies overall. Gold has already broken out against several other currencies, so at this point, it is probably only a matter of time before we follow suit over here against the greenback. I would not be surprised at all to see the $2000 level hit by the end of the year.