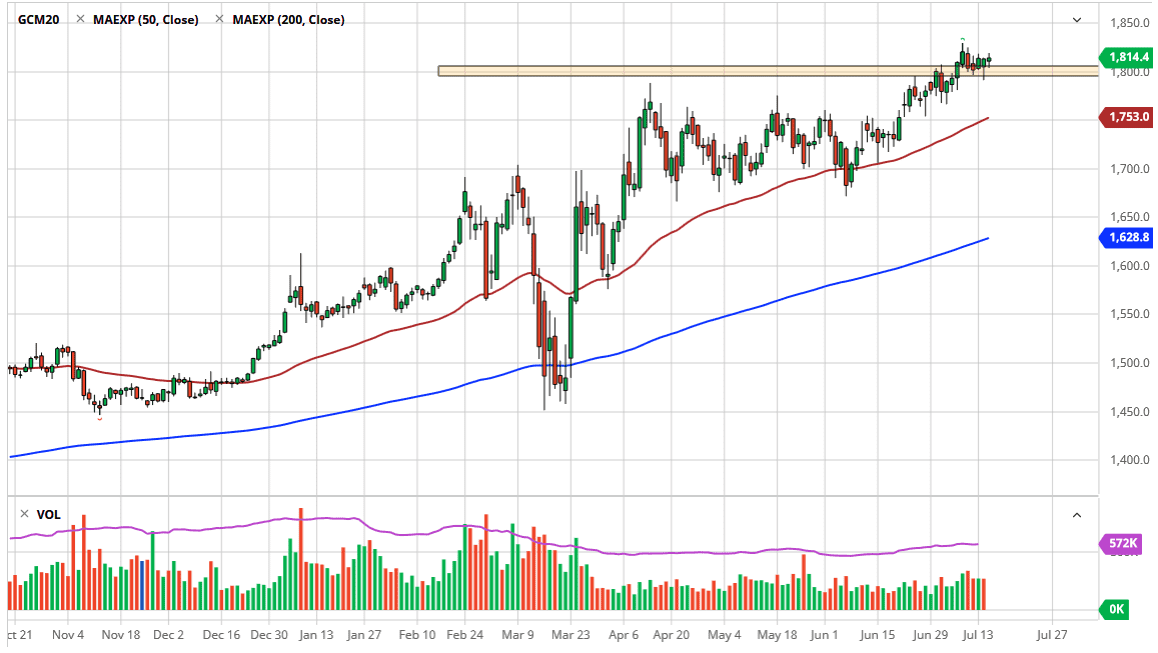

Gold markets have rallied a bit during the trading session in the end, but it was a difficult day all around. We gapped higher ever so slightly at the open, shot up in the air, broke back down towards the $1805 level, turned around to show buying pressure again only to form a very neutral candlestick. This tells me that the market is still moving on the latest headline, which means the coronavirus. All things being equal, I do think that this is a market that has a plethora of fundamental reasons to go higher, so I do not have any interest in shorting gold.

Looking at this chart, you can see that we ended up forming a massive hammer during the trading session on Tuesday, and I think that will be a bit of a proxy for support. The $1800 level of course is an area that would cause a lot of buying pressure, so I anticipate that it is only a matter of time before the buyers get involved there as well. Underneath there, the 50 day EMA is currently crossing the $1750 level, so I think it is only a matter of time before we get an opportunity to buy this market at that level, assuming we even break down that far. It was the scene of a previous resistance barrier, so it makes a lot of sense for it to be a massive support.

Underneath that area, then we have the $1700 level. That is where I would give up on the uptrend and consider forgetting about buying. I do not have any interest in shorting because I know the central banks around the world are going to continue to be very loose with their monetary policy, and in the end that tends to be very bullish for gold. As long as we have that narrative, this is a market that you can only buy and as a result, I remain steadfastly bullish. I believe that the gold has run to the upside and has quite a way to go and I would not be surprised at all to see a move towards the $2000 level over the longer term. Granted, we will see a lot of moves back and forth between now and then but that is my longer-term target. In the meantime, I simply buy short-term pullbacks and take advantage of the volatility.