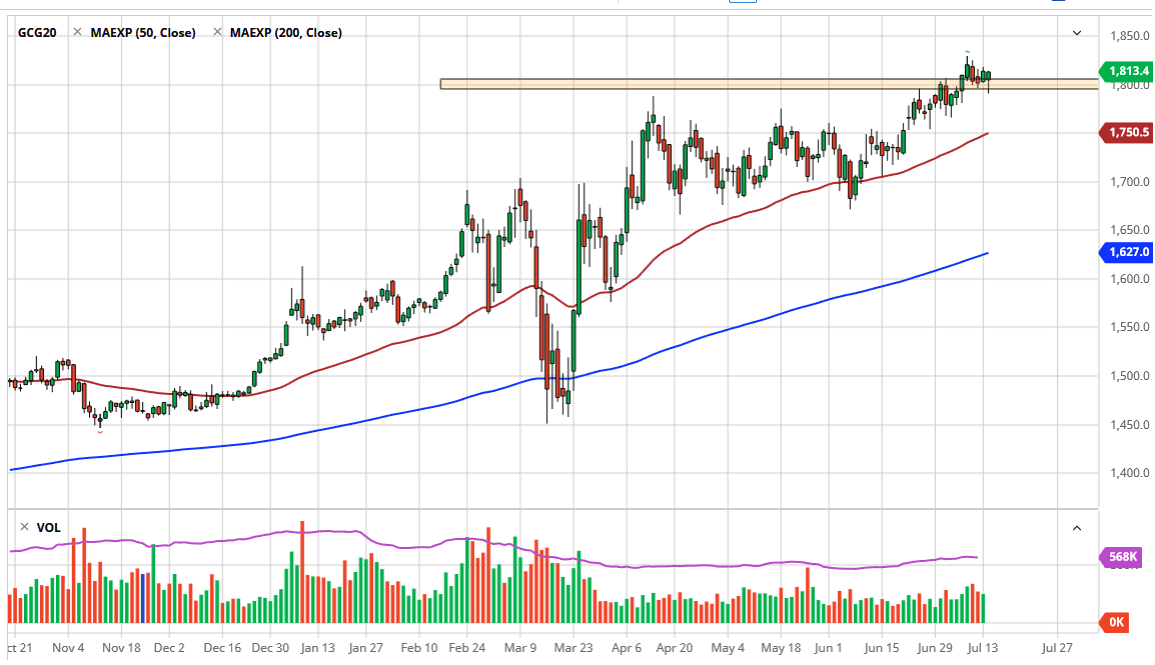

Gold markets had broken significantly lower during the trading session on Tuesday, but we started to see buyers underneath the $1800 level again, which has caught a lot of attention. By turning things back around to form a bit of a hammer, it is likely to see significant buyers. Overall, I believe that it is only a matter of time before value hunters come in and pick up gold because it is so cheap on these dips, as the central banks around the world continue to try and destroy their fiat currencies. The Federal Reserve is one of the biggest culprits, and it is likely that we are going to see the US dollar devalued longer term. That has already happened in gold markets against other currencies, so I do not see why it is going to be any different here.

There is a certain amount of demand for US dollars due to the US dollar denominated debt around the world, so that has made this market a little slower than other currency markets against gold. Looking at this chart, I think there is plenty of support underneath near the $1750 level, where there is the 50 day EMA and of course the $1800 level as we have seen during the day here on Tuesday. The $1830 level above did cause a bit of resistance, but I think it makes for a nice short-term target. Once we break above there it is likely that we go looking towards the $1850 level next as it is the next “round figure.” Longer-term, I believe that we are going all the way up to the $2000 level but it is going to take quite some time to get there due to the fact that there will be so many headlines and there is still a strong bid for US Treasuries. Those assets require US dollars, so that does work against the value of this market.

Having said that, the reality is that the gold market is in a major uptrend, and that is not going to change anytime soon. Buying the dips will continue to be the trade going forward, and I have no scenario right now that I am willing to sell gold, barring something like the Federal Reserve deciding to change its monetary policy, something that it is nowhere near doing right now.