Gold price gains increased sharply, reaching the $1786 resistance, the highest level in eight years, and gold futures for August increased by $19.30 or about 1.1% to $1,800 an ounce, the highest settlement since September 2011. Yellow metal gains increased strongly due to uncertainty about the pace of the economic recovery in the wake of the increase in new COVID-19 cases, which prompted investors to flee to the safe havens. Besides fears of the epidemic, there were global trade and geopolitical tensions. Besides the massive and different stimulus programs announced by global central banks and governments, which continued to push gold prices higher.

Gold futures gained about 12.8% in the April-June 2020 quarter.

In the same vein, September's silver futures rose $0.570, or 0.6%, to $18.637 an ounce, while copper futures for September settled at $2.7285 per pound, up 1.3% in yesterday's session. Silver and copper futures contracts rose by 32% and 22%, respectively, in the second quarter of 2020.

On economic news, a report showed a greater-than-expected improvement in US consumer confidence in June. The report said that the consumer confidence index jumped to a reading of 98.1 in June from a revised 85.9 in May. Economists had expected the CPI to rise to a reading of 90.0 from 86.6 that was announced the previous month. Another report released by MNI indicators showed a continued contraction in business activity in the Chicago area in June. The report said that the Chicago business index rose to a reading of 36.6 in June from a reading of 32.3 in May, but that the reading below the 50 level still indicates a contraction in regional trade activity. Economists had expected the index to jump to a reading of 45.0.

Analysts believe that continued uncertainty about the coronavirus effects on the US and global economic recovery, increased volatility in stock markets, the upcoming US presidential elections, civil unrest in the United States, and global trade friction, along with continued monetary and possibly financial stimulus, are all factors that supported sharp gains in the yellow metal.

Precious metal prices hit their highest levels yesterday after New York Fed Chairman John Williams said that the US economy appears to be improving, but it is still hurt. "The economy is still far from full health, and it is likely that a full recovery will take several years," Williams added. Markets also reacted to the testimony of Federal Reserve Chairman Jerome Powell and Treasury Secretary Stephen Mnuchin. Powell and Mannushin were providing guidance to the House Financial Services Committee on the risks of lifting restrictions on commercial activity without full control of the epidemic.

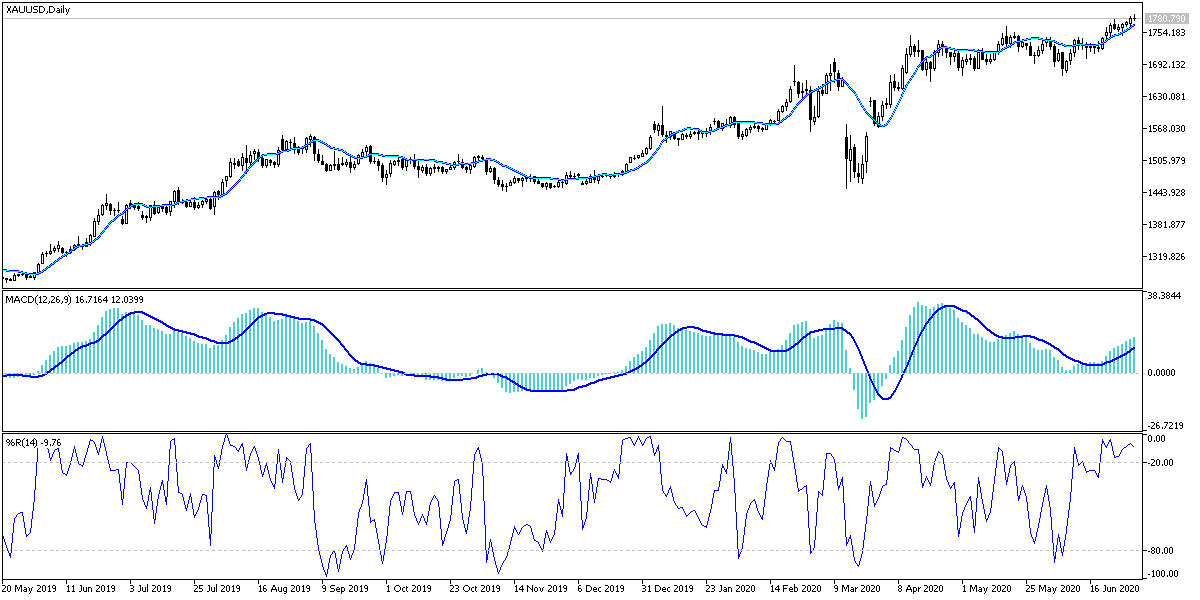

According to the technical analysis of the gold price: The general trend of the yellow metal is still bullish and is closer to test the psychological and historical resistance at $1,800 an ounce. Technical indicators are still giving strong signals of overbought areas and I still believe that selling from the current level will create the best gains, so profit-taking operations will be sharp, with always making sure not to take risks. The closest support levels are now at 1773, 1765 and 1750, respectively.