After limited bearish correction attempts by gold prices at the end of the week’s trading, pushing it to $1795 an ounce, prices returned to rebound upward to $1813 an ounce at the beginning of this week’s trading, near the highest level in nine years. With continued fears of increasing COVID-19 numbers, especially in the major global economies led by the United States. Gold prices stabilized around $1802 at the beginning of trading today, Tuesday, coinciding with the beginning of important economic releases this week, starting from Britain, the United States, and the Eurozone.

The weakening of the US dollar, amid increasing tensions between the United States and China, contributed to the rise in the price of gold. Silver futures contracts closed up nearly 4% at $19.788 an ounce, while copper futures settled at $2.9550 a pound.

According to a report issued by the World Health Organization (WHO), the new cases of coronavirus increased by more than 230 thousand cases worldwide in 24 hours. According to the United Nations health agency, the United States topped that list, with more than 66,000 cases registered, with Florida surpassing the 15,000 new mark on Sunday.

Meanwhile, relations between China and the United States deteriorated last week. As US President Donald Trump told reporters on Friday from Air Force One when asked about Phase 2 of the trade agreement between the world's two largest economies: “The relationship with China has been severely damaged. I am not thinking about it now”. The relationship between the two countries was severely damaged due to the way Beijing dealt with the outbreak of COVID-19. The Chinese government has now announced sanctions against US officials, including Republican Senators Marco Rubio and Ted Cruz, in response to Washington's sanctions against senior Chinese officials.

On the economic side, as markets wait for the outcome of the European summit this week. On Friday, European Council President Charles Michel set out a long-term budget and recovery plan for severely affected members of the European Union, one week before the 27 leaders' summit. In the revised proposal submitted by Michel, it is expected that the size of the European long-term budget called the Multi-Year Financial framework, or MFF, will amount to 1.074 trillion Euros. This proposal was initially discussed on June 19 and faced strong opposition from some members. After that, Michelle held bilateral negotiations with all leaders.

Michel said that opposition from of Denmark, Germany, the Netherlands, Austria, and Sweden will continue.

He suggested that the size of the Covid-19 Shock Recovery Package amount to 750 billion Euros and this money could be used for consecutive loans and spending through microfinance programs. "This is an exceptional one-time tool for an exceptional situation," said Michel. He also put forward a proposal on Brexit 5-billion-Euro reserve to counter the unexpected consequences of the UK's exit from the European Union in the most affected member countries and sectors.

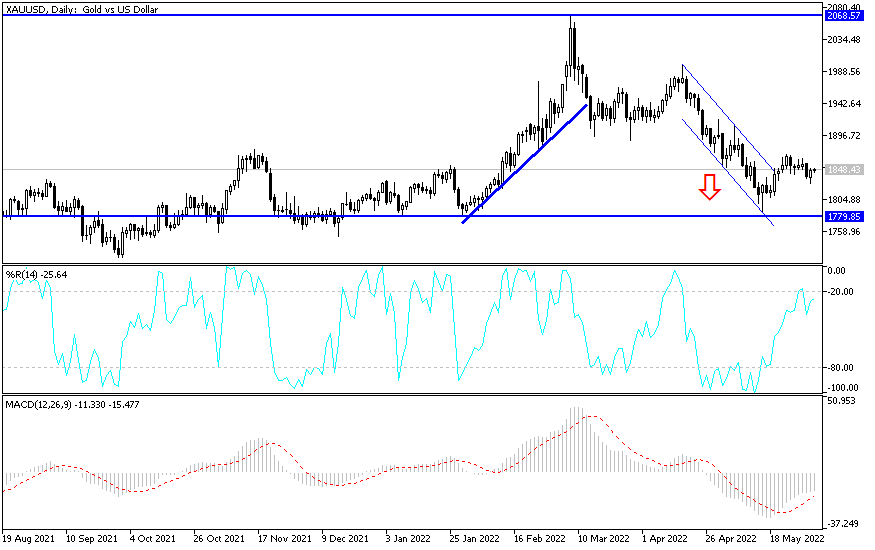

According to gold technical analysis: On the long run, gold general trend is still bullish, taking into account technical indicators reaching strong overbought areas and only waiting for the return of risk appetite and calmness of fears from the second wave of the epidemic, after which we may see strong profit-taking sell-offs, as Gold finds sharp resistance in breaking above $1818 that it recorded recently. Sell-offs does not mean ending the upward trend, but only calming and rearranging the financial centers and reaping the gains of the upward path extended since April, starting from the $1600 resistance. The nearest gold price resistance levels are now 1818, 1829 and 1845, respectively.

Today, gold will interact with the new coronavirus figures, as well as British and American data.