There has been much talk recently about the possibility of gold price reaching the $2000 level, especially with breaking through the $1,800 psychological resistance three trading sessions ago, during which the yellow metal succeeded in testing the $1818 resistance, its highest level for nine years before it closed the week’s trading around the $1798 an ounce. The yellow metal gains came in conjunction with the threat that new and increased US Coronavirus numbers could eventually lead to the shutdown of the largest economy in the world, as the United States is still leading the world in terms of cases and deaths from the disease.

On the economic side, a series of major economic releases were released last week, led by the Markit US Services PMI for June that exceeded expectations for a reading of 46.7 with a reading of 47.9. The Composite PMI - which groups the manufacturing and services sectors - outperformed expectations of 46.8 with a score of 47.9. In the same performance, the ISM services PMI reading exceeded expectations of 50.1 and scored 57.1, and the new orders index rose to 61.6 against expectations of 44. On the other hand, the ISM non-manufacturing index exceeded expectations of 30.7 with a reading of 43.1.

On the other hand, the weekly US jobless claims came less than expected, as 1.314 million claims were recorded against expectations of 1.375 million. In contrast, the US PPI for June came in below expectations, both on an annual and monthly basis of -0.8% and -0.2%, respectively, compared to -0.2% and 0.4%.

Gold prices fell at the end of last week’s trading as global stocks rose after some positive economic data and encouraging news about a vaccine for the COVID-19, which faced concerns about another daily increase in cases in the United States and many other countries around the world.

Silver futures closed higher at $19.053 an ounce, while copper futures for September settled at $2.8975 a pound. Silver and copper futures contracts rose by 4% and 5%, respectively, last week.

The United States experienced an increase in cases of the epidemic almost daily, and the large increase was largely by states in the south and west, which were among the first to relax the restrictions that were put in place during the first wave of the virus in the spring. On the other hand, some US states retract their reopening, while other states order people who arrive from hotspots to quarantine. The strength in the stock markets was the result of an update from Gilead Sciences that its designer drug showed a sharp reduction in mortality risk when used to treat patients with the Coronavirus.

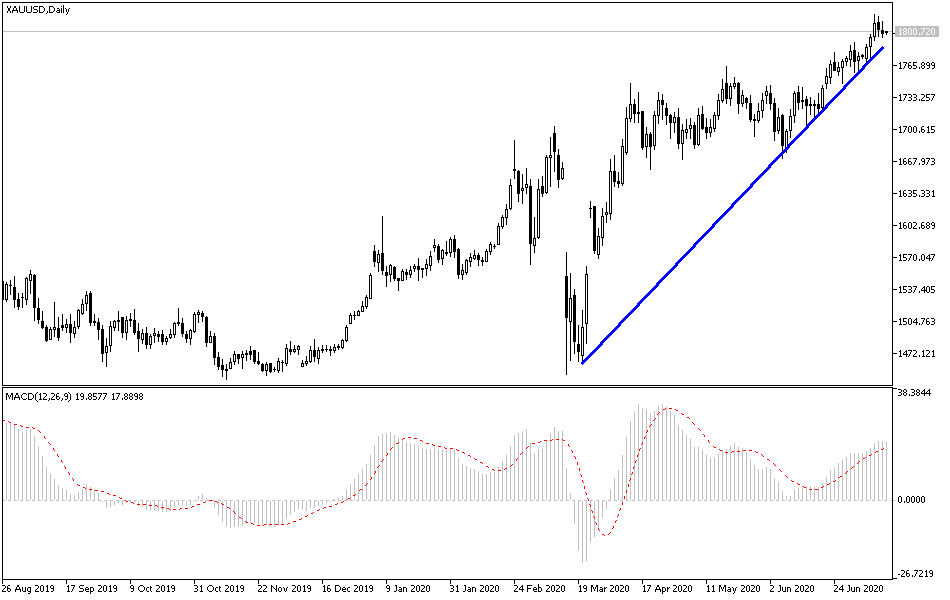

According to gold technical analysis: On the daily chart, it appears that the price of gold is trading within a more severe bullish channel. This indicates strong bullish bias in the long run, according to market sentiment. Meanwhile, the price of the yellow metal is close to the overbought levels of the 14-day RSI. Therefore, bulls will look to extend the long-term bullish momentum by targeting profits at about $1,848 an ounce or higher at $1900. On the other hand, bears will target profits at about $1745 or less at $1691 an ounce.

The future of the $2000 gold price hinges on the breach of the $1,900 resistance. Taking into consideration not to buy with high risk above $1,800, technical indicators have already reached strong oversold areas.