The positive US job numbers were stronger than expected, and it was a catalyst for the markets to give up, even temporarily, of safe havens. Therefore, the price of gold collapsed to $1758 an ounce after the results were announced, and before the end of last week’s trading, the price of the yellow metal bounced back to the $1777 resistance, and closed the week’s tradings around the $1775, with continuing concern about the increasing number of coronavirus cases in the US and in some countries around the world that have lifted some restrictions of economic closure which were in place for months to contain the rapid spread of the epidemic. This concern will negatively affect the performance of the recently revived global financial markets as optimistic economic data from the United States and China has sparked new optimism about the economic recovery from the Coronavirus pandemic.

The Labor Department's closely watched monthly employment report showed that the US economy added more jobs than expected in June to hit the second record in a row. Accordingly, non-farm employment increased by 4.8 million in June, after increasing by 2.7 million in May. Economists had expected jobs to rise by 3.0 million, compared to the 2.5 million jobs that were originally reported for the previous month. Meanwhile, the massive re-employment pushed the unemployment rate down to 11.1 percent from 13.3 percent in May.

Economists said they are cautiously optimistic about the numbers and that employment numbers are still well below pre-epidemic levels.

Before that, data from China showed that the Chinese service sector grew at the fastest pace in more than a decade in June. Accordingly, the Services PMI from Caixin rose to a reading of 58.4 in June from a reading of 55.0 in May. The growth rate was the fastest since April 2010. Total new orders increased at the fastest pace since August 2010 and new export business grew for the first time since January. The composite output index rose to 55.7 in June from 54.5 in May.

On the Coronavirus front, the United States registered more than 53,000 new cases of Covid-19 in 24 hours, representing a record jump. And with the United States leading the numbers of deaths and infections from the deadly virus, Anthony Fossey, director of the National Institute of Allergy and Infectious Diseases for three decades, and one of the leading experts in epidemics in the United States over the past four decades, said that COVID-19 is “unique and strange and I haven't seen a similar virus in 40 years. The virus has a range in which 20% to 40% of people do not have any symptoms”. Fossey told US lawmakers this month that COVID-19, the disease caused by the new coronavirus, surprised him, as it is one of the biggest public health crises in a generation.

"I have been dealing with virus outbreaks for the past 40 years," Fossey said. “I have never seen a single virus - a pathogen - with a range in which 20% to 40% of people do not have any symptoms”

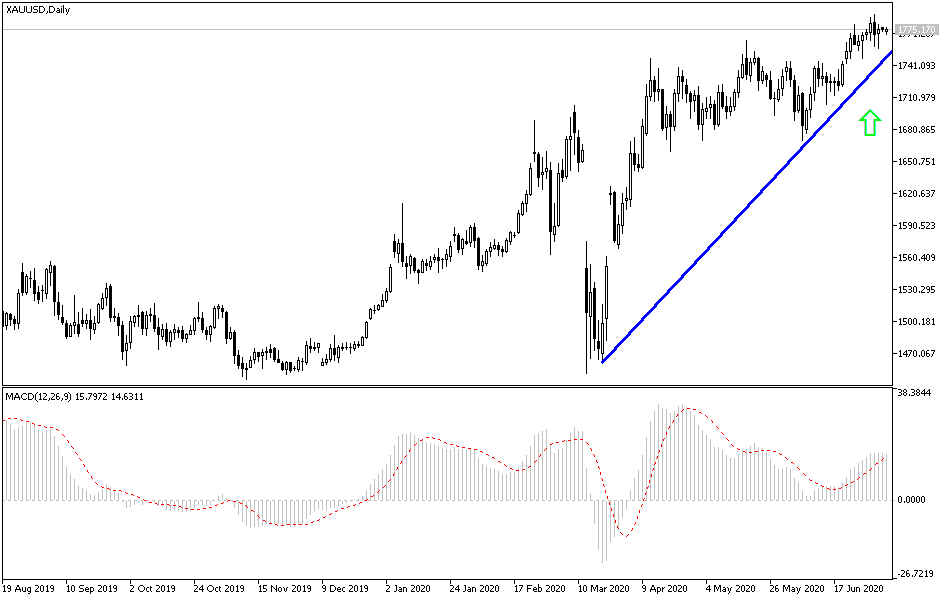

According to gold technical analysis: the general trend of the yellow metal is still bullish and its success in overcoming the $1785 resistance again will support the move towards the following psychological resistance at $1800 and perhaps further if the second Coronavirus wave led to the closure of global economic activity again . We expected before that the recent decline in prices is a very natural correction in the midst of profit-taking operations, and that investors may take advantage of this decline to return to buying gold. The closest support levels for gold are currently 1768, 1755 and 1740, respectively. As long as the Coronavirus persists, buying gold from each lower will remain the best trading strategy for it.

Today's economic calendar is relatively calm in terms of important economic releases, and accordingly, gold will react strongly to the extent of investor risk appetite.