Gold prices maintained its bullish momentum with gains that are the strongest for nearly nine years. During yesterday's session, the $1815 resistance level was reached. Gold then settled around $1810 at the beginning of Thursday’s trading, which is an important trading session and may greatly affect the course of the gold price. Markets are awaiting the results of the meeting between the European Union and Britain, the European Central Bank monetary policy updates, as well as the results of a package of important US economic data. The decline in the US dollar had an important role in the continuation of the gold gains but did not achieve stronger gains in light of the global stock markets gains, supported by optimism towards the near arrival to a vaccine that eliminates Covid-19.

Silver futures ended trading at $19.761 an ounce, while copper futures settled at $2.8850 a pound.

Supporting market optimism, Moderna Biotechnology Company announced that its mRNA-1273 experimental vaccine to counter COVID-19 demonstrated that it was safe and produced strong immune responses in all 45 patients at an early stage OF a continuous human trial.

On the other hand, investors are awaiting the results of the European Union leaders meeting, scheduled for later this week. During the extraordinary summit, the leaders are expected to agree on a 750 billion euro recovery fund for European economies suffering from the effects of the epidemic. The high price of gold also came amid escalating tensions between the United States and China and uncertainty about the pace of the global economic recovery. US President Donald Trump has ordered an end to the special status of Hong Kong under US law, and in return, Beijing has pledged to execute revenge sanctions against American individuals and entities. "Hong Kong affairs are purely internal affairs of China, and no foreign country has the right to interfere," the Chinese Foreign Ministry said.

According to a special survey issued by the Federal Reserve Bank, economic activity has recovered in most regions of the country, but it is still far below pre-pandemic levels, as the country faces high levels of uncertainty. The bank reported that the latest survey of economic conditions across the country had found an improvement in consumer spending and other areas, but said those gains were from very low levels seen when large-scale closings drove the country into a deep recession. The report said that trade contacts in the 12 Federal Reserve regions remained concerned about the future of the US economy.

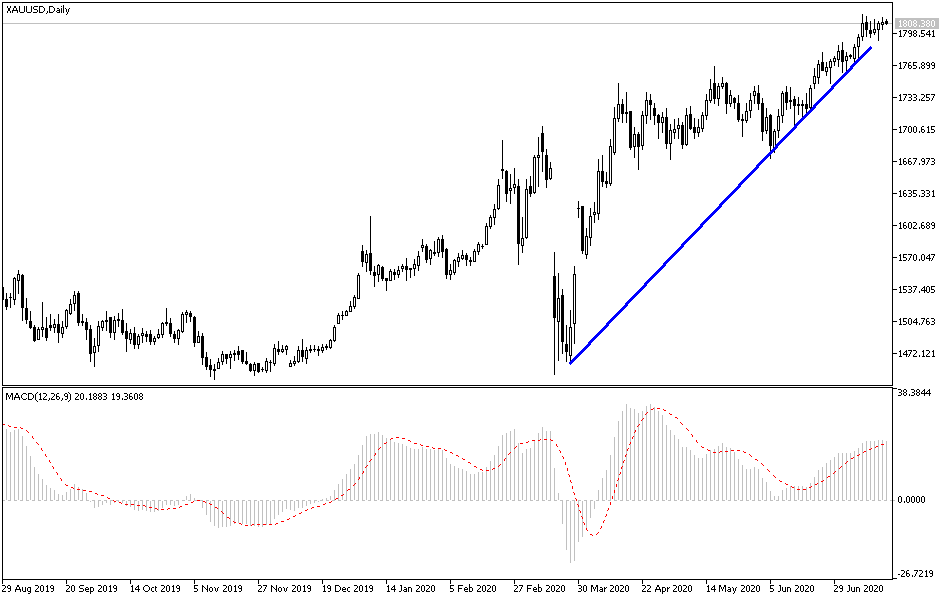

According to the technical analysis of gold today: On the daily chart, the price of the yellow metal appears to have taken a sharp path within a bullish channel. This indicates a long-term bullish bias in market sentiment. It is now closer to crossing over the 14-day RSI levels. Thus bulls will look to take advantage of this momentum by targeting long-term profits at about $1861 or higher at $1901. On the other hand, bears are hoping for a trend reversal by targeting profits at about $1764 or lower at $1720.