A new record price for an ounce of gold was recorded at the beginning of trading this week as the yellow metal rose towards the $1821 resistance, the highest level in nine years. This was before settling around the $1818 per ounce in the beginning of Tuesday’s trading, the same resistance that was recorded at the beginning of the current month's transactions. What pushed the gold to achieve these gains was an observed decline in the US dollar and global concerns about a second outbreak of COVID-19, which may eventually lead to the closure of the global economy. What capped these gains was the successive news around the world about the success of many vaccines to combat the deadly disease.

The number of COVID-19 cases worldwide has risen above 14.5 million, and the number of cases in the United States has risen to 3.77 million, and the death toll has exceeded 140,000, as new cases continue to rise in US states in the south and west. However, there was positive news from two separate trials of vaccine candidates, both of which provoked immune responses. Experts caution that the data is preliminary and more evidence is needed from larger trials.

In an interview with Fox News, US President Donald Trump defended his record in the pandemic management, but he again claimed that the increased numbers of tests are behind the number of case booms in the United States, and he has lessened the warnings of an infectious disease expert, Dr. Anthony Fauci, calling it "disturbing." Trump claimed that the youths were responsible for the recent surge in cases and claimed that they would "recover in one day."

To counter the epidemic, Trump said he did not support a federal mandate to wear face masks, a move health experts say is necessary to contain the spread of deadly disease, along with frequent hand-washing and social distancing. Despite this, nearly half of the US states have taken some measures that require wearing face masks, and outside the United States, more countries adopt the obligation to wear face masks, including France, where it is required in all indoor places, and the United Kingdom, where it will be required starting from Friday.

Commenting on Trump policy, Schumer, the Senate Minority Leader, wrote that Trump's comments showed he still denies the severity of the crisis: “He still does not have enough national testing strategy and continues to use defense production law, wasting valuable time and resources,” Schumer wrote that in a letter by Democrats as they prepare to discuss the next economic stimulus bill.

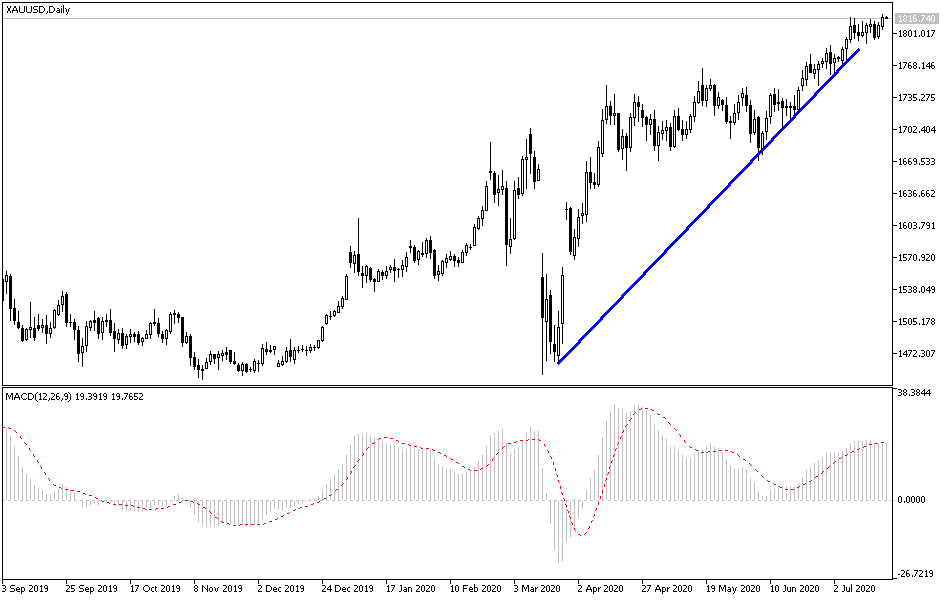

According to technical analysis of gold: The bullish momentum still dominates the gold performance and does not care about the technical indicators reaching strong oversold areas, as factors of increased gains remain, including concerns about the spread of COVID-19 virus and concern about the future of an important European agreement to support the bloc in facing the pandemic, fears about the future of Brexit, the American elections, and the tensions between the two largest economies in the world. The closest resistance levels for gold are now 1825, 1840 and 1865, respectively, areas that may support a rapid transition to test the next psychological resistance at $1900 an ounce. A breach of the current bullish trend may occur if the metal price moves towards the $1785 support.