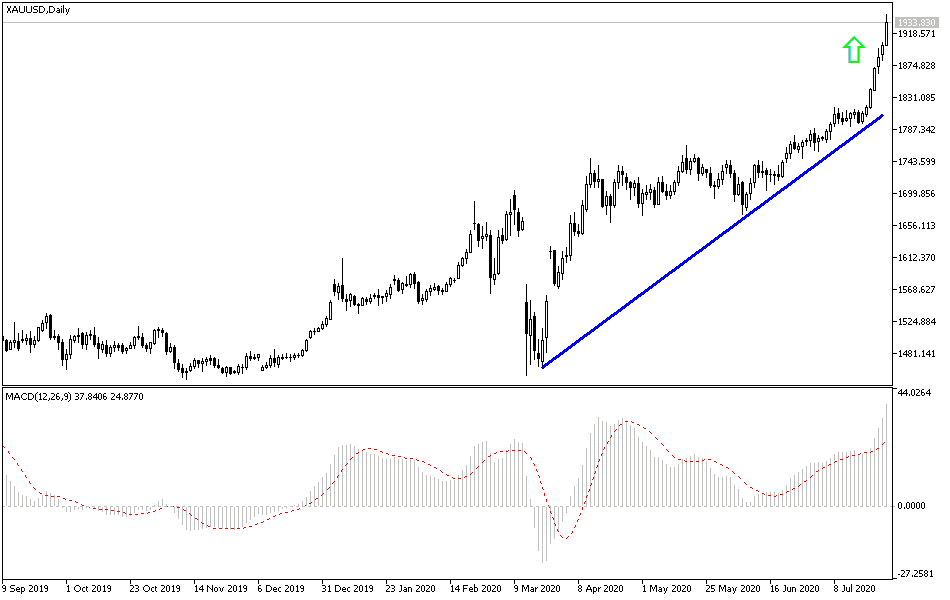

With the constant stability of gold prices above the $1,800 resistance, talk increased in the financial markets about the possibility of moving towards the record and historical price of $2000. Expectations increased strongly with the price of gold exceeding the psychological resistance barrier at $1900 an ounce as it reached $1906, the highest for the price in nine years, and closed the week’s transactions around $1902. The yellow metal has become the focus of markets and most closely watched by investors, wondering where will the price reach? Has it reached saturation areas and needs to be corrected? Or is the opportunity real and the closest to the historical resistance at $2000?

The answer to what goes on in the minds of investors and occupies the minds of the markets depends on the continuity of gains factors. The US dollar reached its lowest level in four months, the US-China tensions are at their strongest, the American presidential elections are approaching, and Trump's opportunity is dwindling. The Coronavirus is still standing, and it is claiming more economic and human losses. Even with the announcement of many vaccines to combat the disease, it did not affect the price of gold in stopping the gains train.

Reversing to all of the above means quick profit-taking sales. Technical indicators have reached strong overbought areas and we do not rule out breaking the $1,800 resistance before starting a new buying base, and with the continuation of these factors, we cannot exclude the opportunity of reaching the psychological and historical resistance level at $ 2000 an ounce. The recent European stimulus, the soon expected US stimulus, and the easing of monetary policies by global central banks, all confirm the depth of the economic crisis caused by the pandemic and thus give the yellow metal the floor to stick to the gains.

Gold price gains await the interest rate decision by the US Federal Reserve this week along with more press briefings written by Governor Jerome Powell, Chairman of the Federal Reserve. Although market participants are extensively expecting the US central bank to ensure that rates will not change, an optimistic commentary on fundamental expectations may enhance the prospects for future price movements. Gold property, such as hedging, can outperform global trade and geopolitical tensions by pushing the price of gold higher. Taking into consideration the continuation of the US currency drop or stalling after recent losses.

Inflated Fed Balance Sheet is currently hovering around $7 trillion. Besides, the use of the Fed's lending facilities may also boost the gold hedging appeal, assuming that these new measures will play a role in increasing inflation. Last Thursday, Steven Mnuchin, the US Treasury secretary, stated that with Mark Meadows, the White House chief of staff, they are finalizing the additional stimulus bill. He added that the payroll tax will stop, something the US President was also defending by saying that it will not be included in the new aid package. However, the Secretary of the Treasury indicated that such measures may be included in future legislation.

A majority of Senators also indicated that Republicans will later unveil the Virus Package Bill this week. Lawmakers are feeling the pressure for the $600 employment benefit a week that was signed into law in March. Although friction in the talks may shake gold, more details of the response and the release of details, if positive, could be a catalyst for the XAU/USD gains.