As expected, the recent and continuous gold gains pushed the technical indicators to overbought areas, and we noted that we may see profit-taking sales for the correction. Yesterday, gains reached the $1789 resistance, the level highest in almost eight years. Correction sales pushed the price towards the $1759 support before settling around the $1771 dollars an ounce in the beginning of Thursday’s trading. This is before the announcement of the important US economic data, which will draw a picture of the closing transactions for this week. Tomorrow there will be an American holiday. Alongside profit-taking sales, gold will interacted with upbeat data on US private sector employment and manufacturing activity around the world.

Despite this, the weakening of the US dollar and the uncertainty about the pace of economic recovery amid a rapid escalation of coronavirus cases throughout the United States, and many other countries, has limited the drop in gold prices.

Similar to the gold performance, silver futures ended trading down with about 2.3% at $18.218 an ounce, while copper futures closed at $2.7340 a pound.

On the economic side. A report from the Institute of Supply Management showed that manufacturing activity in the United States saw unexpected growth in June. ISM said that the Manufacturing PMI jumped to a reading of 52.6 in June from 43.1 in May, and any reading above the 50 level indicates growth in manufacturing activity. Economists had expected the index to rise to a reading of 49.5, which still indicates a modest contraction in manufacturing activity.

A separate report issued by the ADP payroll processor showed a significant increase in private sector employment in June as well as a large upward revision of the data for May. ADP said that employment in the private sector jumped by 2.369 million jobs in June, lower than economists' estimates for an increase of about 3,000 million jobs. However, the revised data showed that private sector employment increased by 3.065 million jobs in May compared to a previously reported loss of 2.760 million jobs.

And for US monetary policy. With interest rates expected to remain close to zero in the foreseeable future, the minutes of the Federal Reserve’s last meeting in June showed that participants discussed new tools for conducting monetary policy. The minutes showed that the meeting included briefings on the roles of forward guidance and large-scale asset purchase programs in addition to implementing the yield curve control.

In discussing future guidance and asset purchases on a large scale, many participants indicated that the economy is likely to need support for some time and that it will be important for the Federal Reserve to provide more clarity on the possible path to interest rates and asset purchases.

The minutes indicated that the participants in the meeting generally indicated support for forward results-based guidance, where a positive number spoke of guidance related to inflation outcomes. Meanwhile, two of the meeting participants indicated a preference for forward guidance related to unemployment and a few others suggested calendar-based guidance.

At this meeting, the Federal Reserve voted unanimously to keep the US interest rate target at zero to 0.25 percent and indicated that rates will remain at current levels until policymakers are confident that the economy has passed the last situation. The economic projections presented at the meeting showed that most Fed officials expect rates to remain at current levels until 2022.

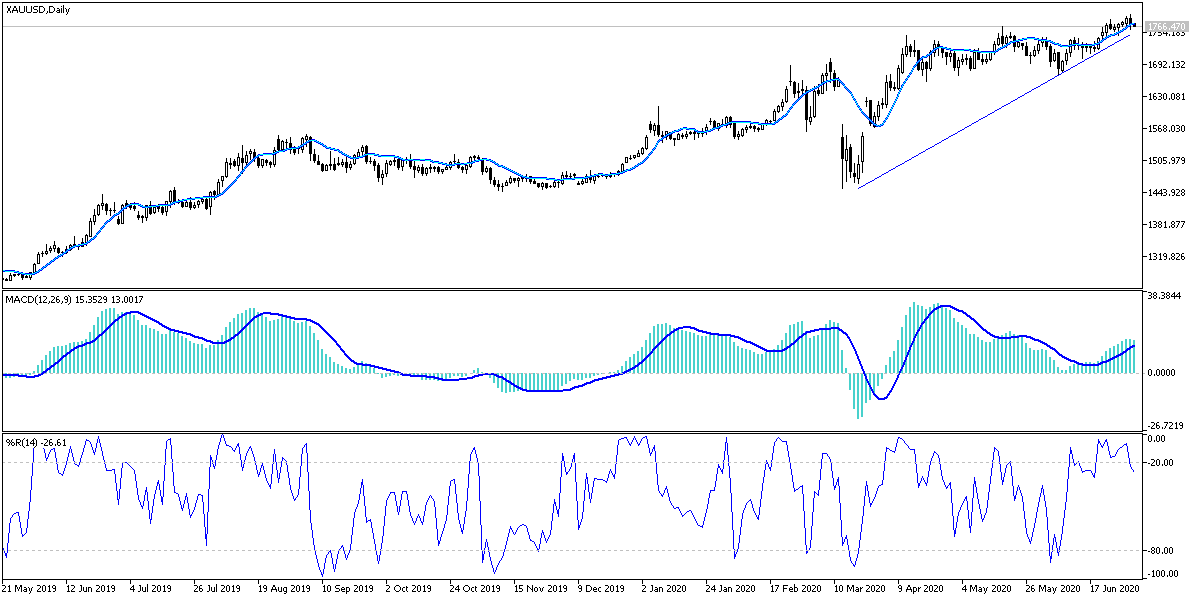

According to the technical analysis of gold: The recent correction of gold prices is healthy and strongly expected, and this decline has not yet reached a reversal of the general trend to a downward trend that will only be made by the movement of gold around and below the 1700 support level. Concern about the second wave of the Corona epidemic and the increase in trade and political tensions around the world will still be factors that support the continuation of the gold gains, and this decline may constitute a new starting area for the yellow metal, and therefore the buying operations may return again from the support levels of 1759, 1745 and 1730, respectively. On the upside, the resistance crossed the 1785 level again, which could push the price of gold higher than the $1,800 psychological resistance. I still prefer buying gold from every lower level.

Gold price will react today with the announcement of the important US job numbers report.