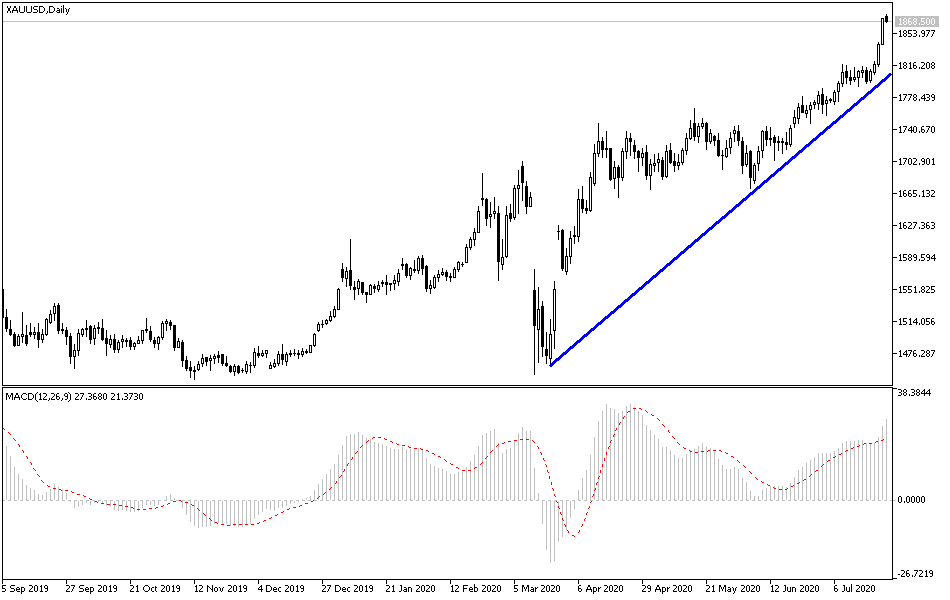

In an impressive performance, the price of an ounce of gold continuously and steadily achieves gains, as it reached the $1874 resistance at the beginning of today’s trading, its highest level in nine years. Gains have increased recently amid escalating tensions between the United States and China and concerns over the rapid spread of coronavirus in the United States threatening the administration's plans to reopen economic activity. With the US dollar tumbling to its lowest in four months, the rise in gold prices was normal. In the same performance, silver futures settled at $23,144 an ounce, the highest level in nearly seven years. Copper futures closed at $2.9245 a pound.

In an unusual comment, US President Donald Trump said that the US pandemic may "get worse before it gets better," while the country reported more than 1,000 Corona-related deaths on Tuesday. More than 65,000 new cases of the disease have been registered. This adds to the national total of more than 3,874,000 cases since the epidemic began.

On the other hand, tensions between the United States and China came to the front again after the United States asked Beijing to close its diplomatic consulate in Houston within the next 72 hours, and Chinese Foreign Ministry spokesman Wang Wenbin condemned the measure and warned of retaliation if the United States did not reverse that decision. Economists argue that news on the geopolitical front is sure to weigh on as risks flow and fears grow that political chaos could weaken the global recovery from the pandemic, especially if the rhetoric turns tougher over the summer.

The Chinese Foreign Ministry said it had ordered the closure of the consulate, which serves most of the south, in what it described as an "unprecedented escalation" by the United States, threatening retaliation if the decision was not reversed. For its part, the US State Department said it had ordered the closure to protect US intellectual property and private information, after that China announced that it would take unspecified "necessary measures" after the US government imposed trade sanctions on 11 companies it says were involved in human rights violations in the northwestern Xinjiang region in China.

Gold received support from expectations of an additional round of US fiscal stimulus, which was seen as contributing to a possible weakening of the US dollar. A weak dollar could be supportive of the commodities priced in it. This week, silver rose by about 17%, although analysts said that the white metal was lagging behind gold gains.

According to the technical analysis of gold: The consecutive increases in the gold price pushed technical indicators to strong overbought areas, and more volatility is expected for the yellow metal with the beginning of thinking about selling to take profits, and this may be a surprise at any time. It is never advised to buy from the current levels but rather wait for the sale-offs and buy from lower levels. The most important resistance levels for gold are 1869, 1877, and 1895, respectively. Strong selling may push the price towards 1800 before returning to the new bullish path.

Today, the gold price will react to updating global figures relating to infections and deaths from the Corona pandemic, along with the status of US/Chinese relations, the results of the Brexit round of negotiations, and the announcement of US weekly jobless claims.